We are excited to share a worked example of how Participating Forwards are represented in Hedgebook’s Exposure Tool. A Participating Forward is a structured option which provides a known worst-case rate (Protection Rate) and the ability to participate in favourable movements for a portion of the structure (often 50%).

Participating Forwards: UK Importer

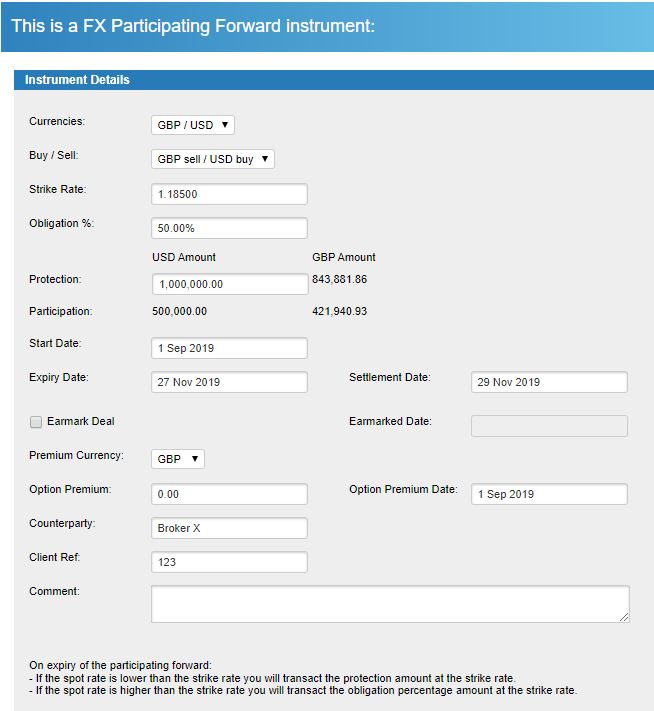

In this example, a UK based importer has USD costs that are being hedged with the following Participating Forward:

On expiry of the participating forwards:

– If the spot rate is lower than the strike rate (1.1850) the importer will transact the Protection Amount ($1,000,000) at the strike rate (1.1850).

– If the spot rate is higher than the strike rate (1.1850) the importer will transact the obligation percentage amount ($500,000) at the strike rate (1.1850) leaving the remaining $500,000 to be transacted at the higher market rate.

Prevailing Market Rates

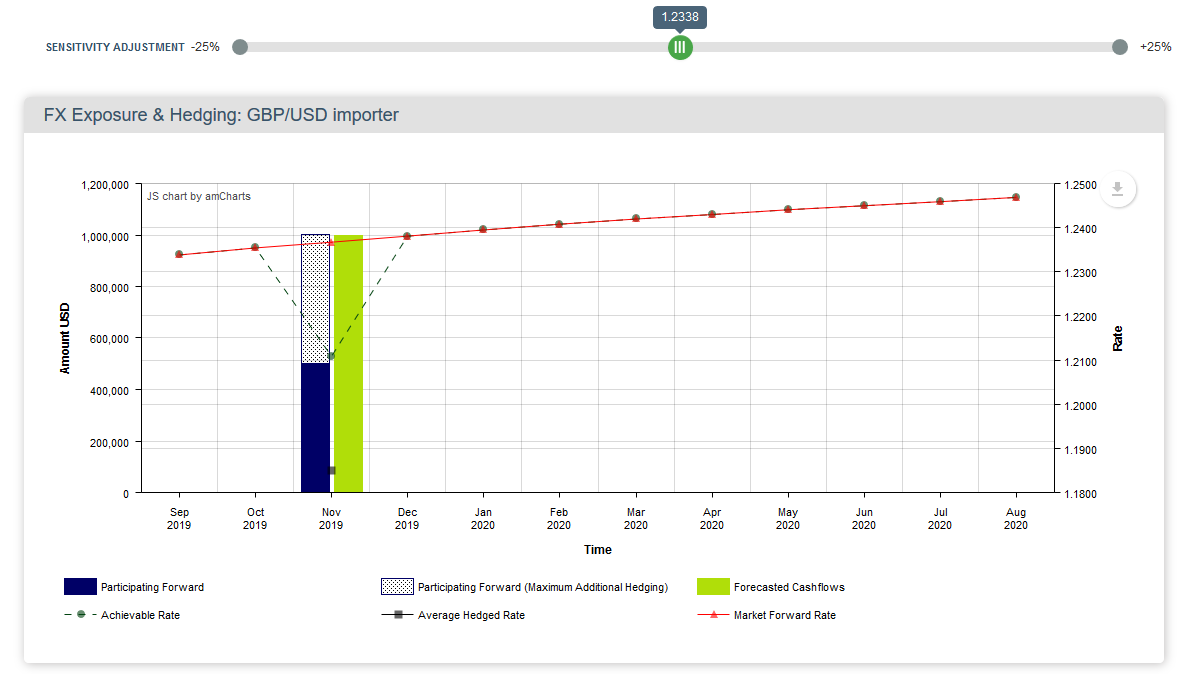

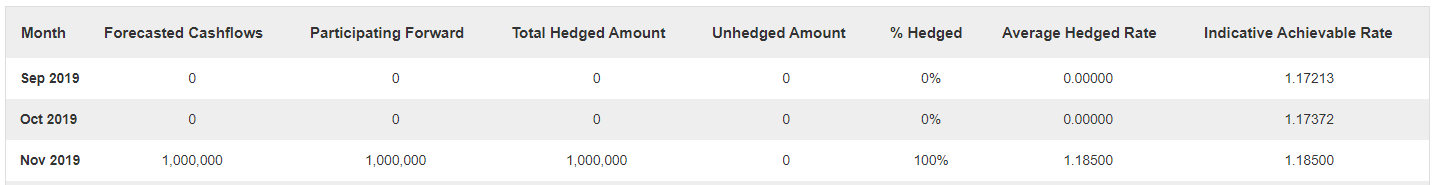

When the Exposure Tool is first launched, the displayed position is determined by the prevailing market rate. In our example the market rate was 1.2338:

The forward rate for Nov 2019 (the month the Participating Forward expires) is 1.2367. Hedgebook compares the forward rate to the strike of the Participating Forwards to determine how the position is displayed.

Since 1.2367 is higher than the strike rate (1.1850) 50% (the obligation percentage) of the Protection Amount is deemed to be transacted at the strike rate, 50% is assumed to be transacted at the more advantageous market rate.

The solid blue area of the bar represents the portion of the hedge that is transacted at the strike rate ($500,000 at 1.1850). The shaded area of the bar represents the portion of the hedge that would be transacted at the market rate ($500,000 at 1.2367).

Another Scenario

In this scenario, the Exposure Tool shows $500,000 of hedging at the strike rate of 1.1850 and $500,000 of an “unhedged” amount i.e. the portion that can be bought at the more advantageous prevailing market rate. The combined rate, or Indicative Achievable Rate, is the weighted average rate of 1.21085 (average of 1.2367 and 1.1850). In our example the Forecasted Cashflow is equal to the Protection Amount of the Participating Forward.

If the Forecasted Cashflow was greater than the Protection Amount, the Indicative Achievable Rate would include the difference between the Forecasted Cashflow and the Protection Amount balance at the prevailing market forward rate.

For example, if the Forecasted Cashflow was $2 million, $500,000 would be hedged at 1.1850 and the remaining $1.5 million would be transacted at the prevailing market rate.

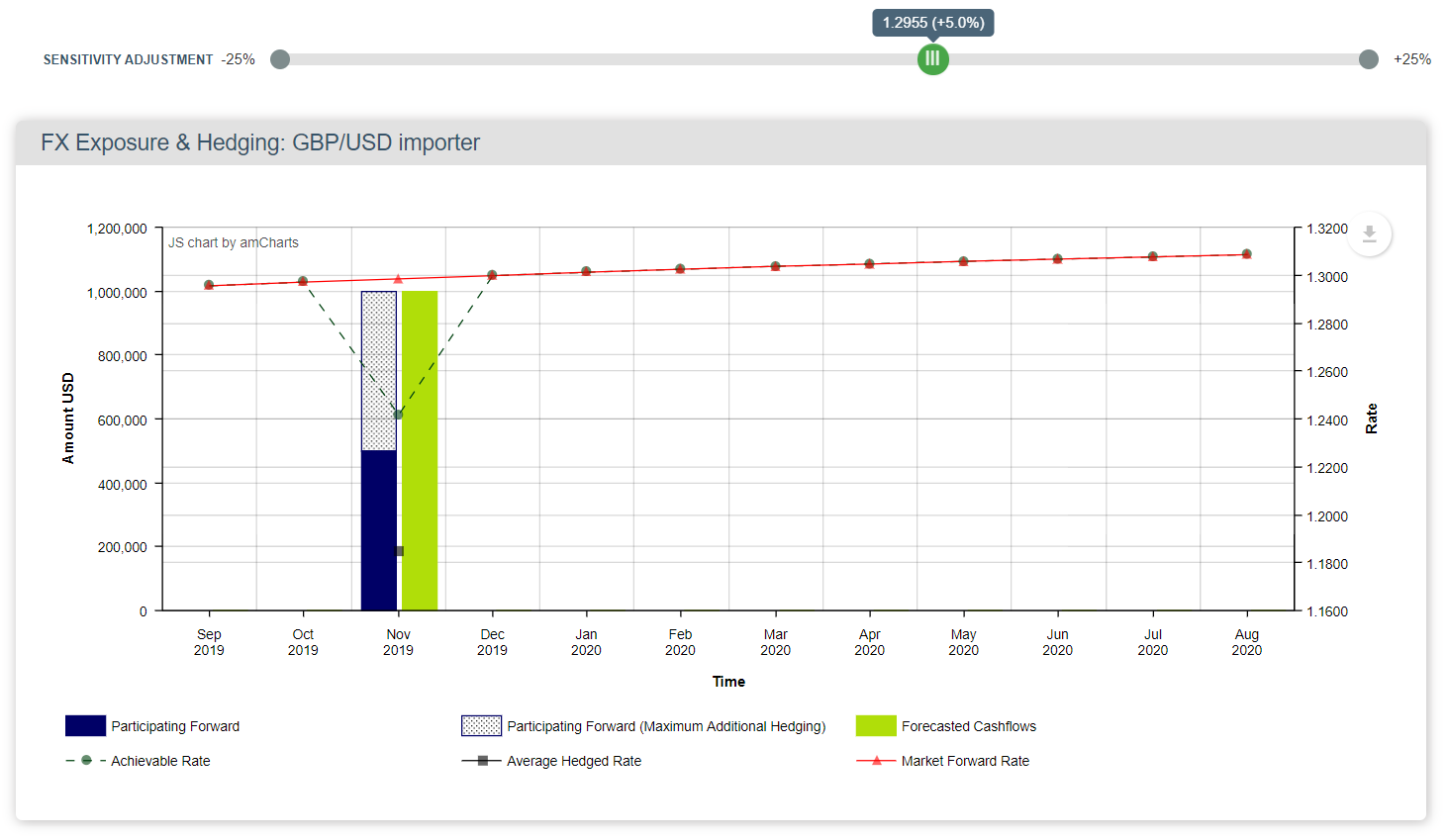

In our example the prevailing market rates are higher than the strike of the Participating Forward, therefore, no matter how far to the right (stronger GBP) we drag the Exposure Tool slider there is only $500k hedged at the strike 1.1850, the balance will be transacted at the more advantageous/higher rates.

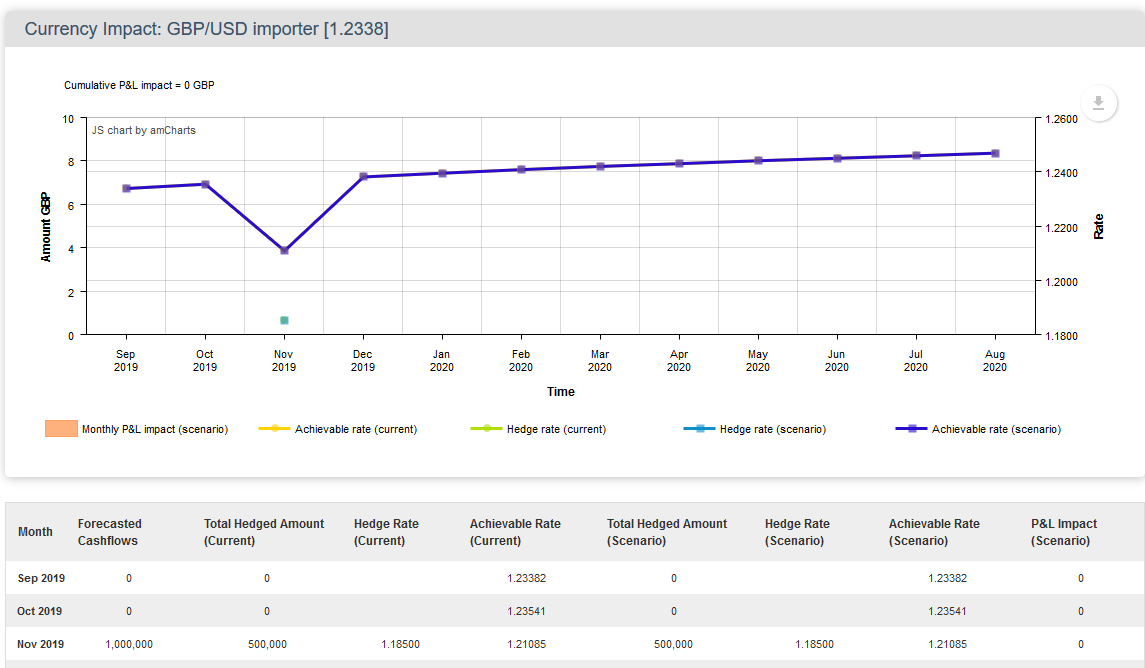

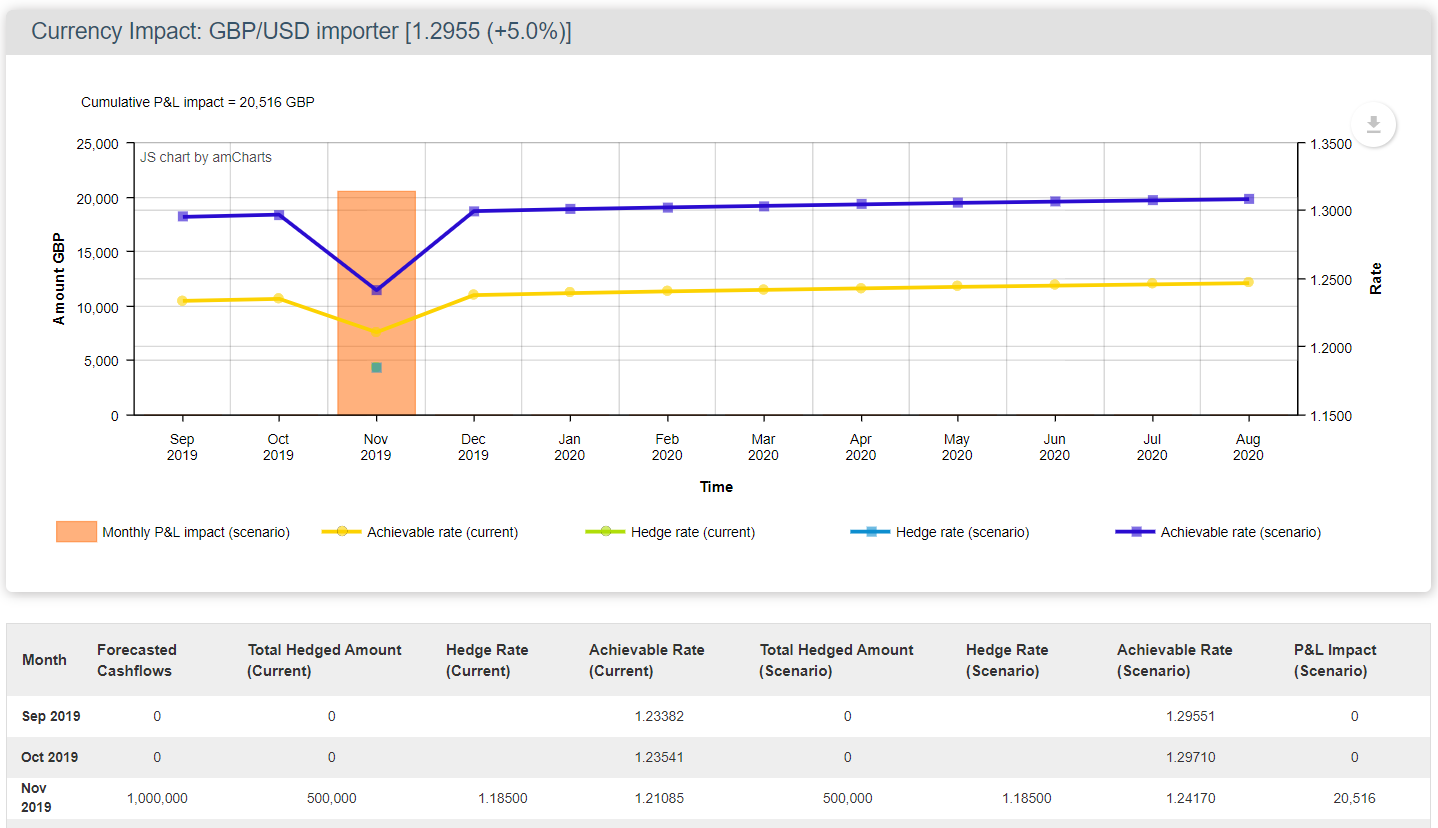

Currency P&L Impact

The Exposure Tool calculates the Currency P&L Impact of hypothetical movements in the exchange rate. When the Exposure Tool is first launched the Currency P&L Impact is zero i.e. the prevailing market rates set the base from which hypothetical movements are compared.

So, initially, the Hedge Rate (current) and Hedge rate (scenario) overlap, so too the Achievable Rate (current) and Achievable Rate (scenario). Since we have only included a single month of exposure and hedging (Nov 2019) the rest of the Achievable Rate line tracks the scenario forward curve.

Hypothetical Exchange Rate Scenarios

When we simulate hypothetical exchange rate scenarios by moving the slider at the top of Exposure Tool, Hedgebook calculates the impact on the Participating Forward and the P&L impact.

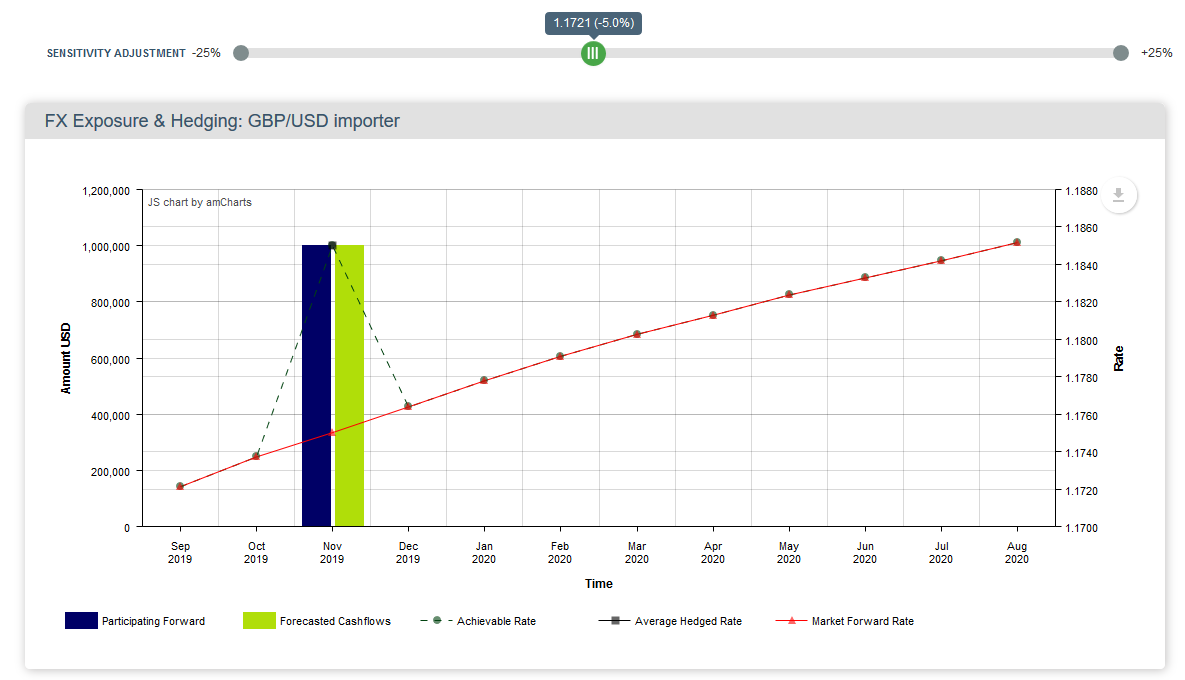

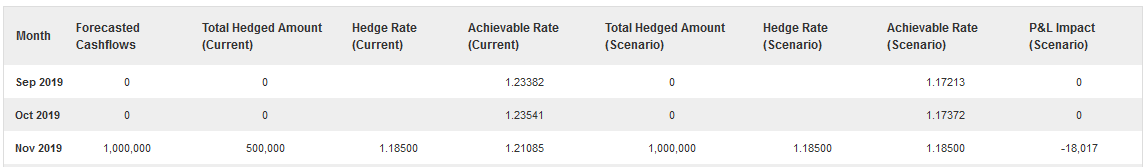

Let’s consider the impact of a 5% weakening of the GBP/USD exchange rate:

The market rate (1.1750, the implied Nov 2019 forward rate) is below the strike of the option (1.1850) so the bar is solid blue indicating that the full Protection Amount of $1,000,000 will be exercised at the strike rate. The Hedged Rate and the Achievable Rate are the same (1.1850).

By moving the slider away from the prevailing market rate, we create a P&L impact:

The Currency P&L Impact is calculated by the difference in the Achievable Rates i.e. ($1,000,000/1.21085) – ($1,000,000/1.1850) = -£18,017. The importer is £18,017 worse off if the GBP/USD exchange rate falls 5% from current rates.

For the importer, a stronger GBP/USD exchange rate has a positive P&L impact as the amount of GBP required to purchase the same amount of USD is less. If we simulate a 5% stronger GBP we get the following profile:

A +5% movement implies a Nov 19 market rate of 1.2984. The solid blue represents the obligation amount at 1.1850. The shaded amount is assumed to be transacted at the more advantageous market rate. The implied Achievable Rate is 1.2417.

The difference between the current rates and the +5% scenario creates a positive P&L impact of +£20,516 (1,000,000/1.21085) – (1,000,000/1.2417).

Hopefully the above explains the methodology of the Exposure Tool when considering a Participating Forward. Any questions can be directed to [email protected].

Hedgebook: www.hedgebookpro.com