Import and export companies globally, face the daunting task of dealing with foreign exchange risk that can easily alter revenues from overseas. While we often think of FX risk in terms of large companies, for those with smaller cash reserves, exchange rate fluctuations can be the difference between profits and losses.

FX volatility impacts large and small

FX volatility makes it difficult for firms, both large and small alike, to accurately price products sold overseas where a non-domestic currency is used.

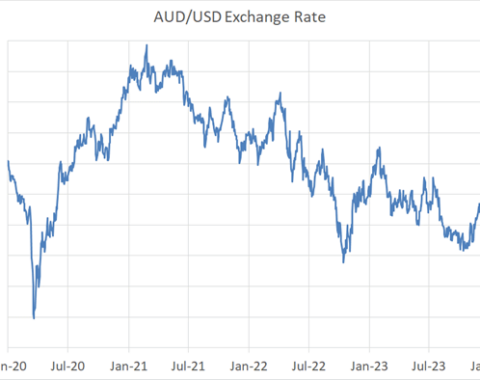

For companies in Australia for example, overseas sales are rarely calculated in Australian Dollars, considering it is a generally accepted practice that export sales are invoiced in the foreign buyer’s currency. With the Australian Dollar’s exchange rate seeing large, rapid swings frequently against major currencies such as the the Euro, Japanese Yen, and U.S. Dollar, it has often been more difficult for companies dealing with business overseas to accurately forecast revenue streams.

This risk to the bottom line – the likelihood that a change in foreign exchange rates will negatively impact revenues – is known as foreign exchange risk, or currency risk.

Exporters exposure to currency risk

For exporters, currency risk materializes when exchange rate volatility results in the company repatriating fewer revenues abroad, when the domestic currency strengthens relative to the foreign currency. For importers, this risk is the exact opposite: currency risk materializes when the domestic currency weakens relative to the foreign currency. This is true because of purchasing power parity, the relative equilibrium of exchange rates between two currencies so that an identical good in country A costs the same in country B.

Therefore, if exchange rate fluctuations cause the currency of country A to appreciate relative to the currency of country B, goods produced by country B will become cheaper to consumers in country A. If consumers in country A find that they can get the same product in country B but at a cheaper price due to the exchange rate fluctuation, they will purchase it. But for consumers in country B, whose currency has weakened, they will not consume the identical product from country A, as it would cost more.

Currency Risk for Importers and Exporters – Transaction Exposure

Exporters and importers face these same risks. Importers in country A see weakened demand and smaller revenues as a result of the stronger currency; while exporters in country B see strengthened demand and greater revenues as a result of the weaker currency. When a company’s cash flow is negatively impacted by currency risk, it is known as transaction exposure.

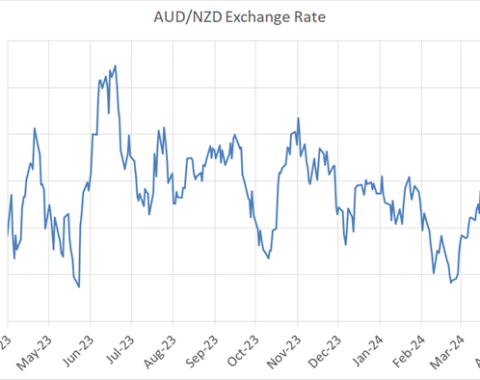

Consider the FX relationship between two closely knit economies, Australia and New Zealand over the past year.

This exchange rate volatility demonstrates why hedging is necessary. Let’s say that an Australian firm sold NZ$100,000 worth of product in New Zealand in May 2023, when the AUD/NZD traded at 1.0574. Given the exchange rate, the Australian firm would expect to receive AU$94,571 in return. However, if hedging wasn’t utilized, and the Australian firm repatriated its funds just one month later in June 2023 when the AUD/NZD traded at 1.10.46, it would only receive AU$90,530 in return. By not hedging, the Australian firm cost itself AU$4,041.

Accounting and economic exposure

There are two other main types of currency risk for importers and exporters: accounting exposure and economic exposure. Accounting exposure comes about when firms have offshore liabilities and must convert the foreign denominated liabilities back into the domestic currency.

Given exchange rates do not remain stable, the liability conversion results in either gains or losses. Economic exposure tends to be limited to firms only operating domestically.

For example, if an Australian firm only sells at home, but the Australian Dollar gains in value, consumers might look to competitors overseas given increased purchasing power; despite not being a participant in international markets, the shift in exchange rates could still have a negative impact on business.

Of course in all of this managing your FX Exposure to the parameters set by your board can be critical to minimizing currency risk for importers and exporters. Hedgebook not only provides a highly accurate FX Exposure Tool to model the risk through scenario creation, it enables you to create easy-to-read board reports against that modelling.

If you would like to take a look at how that would work for your business, please reach out and we will gladly give you a quick online demo.