Hedgebook dashboard and FX help videos

This quick guide gives an overview of how to use the primary functions within Hedgebook. Although it is not exhaustive, it should answer many of the questions you may have on using the key tools. Please also note, when it comes to financial derivatives, there is some variation in terminology and often multiple names are used to describe the same thing. We have attempted to give some alternatives that you may come across.

If you have any questions or can’t find the answer you’re looking for please get in touch and a real person will respond to your query.

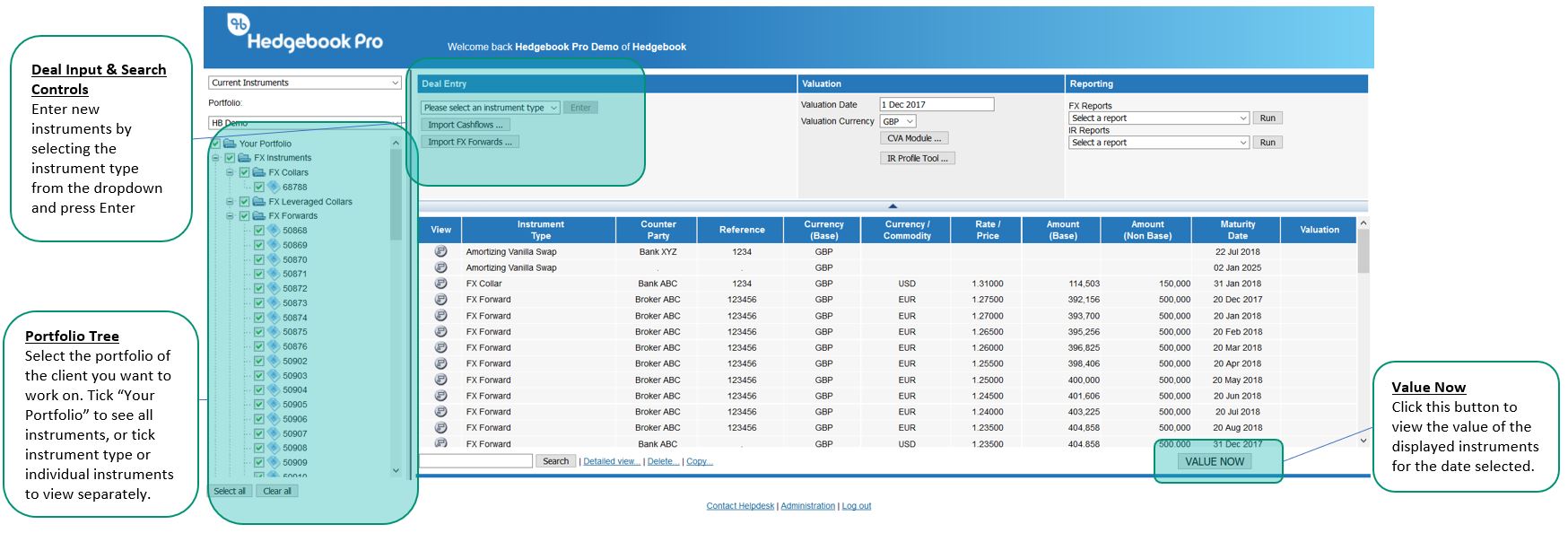

The Dashboard is made up of six primary components

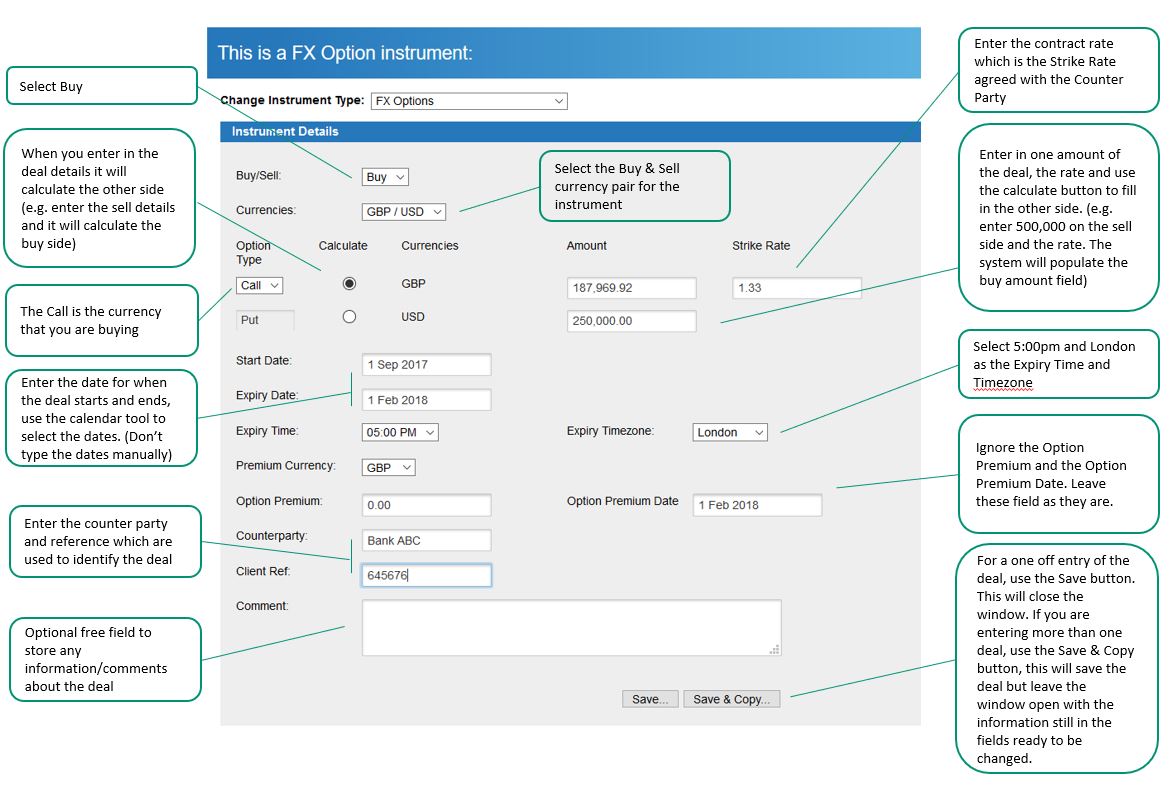

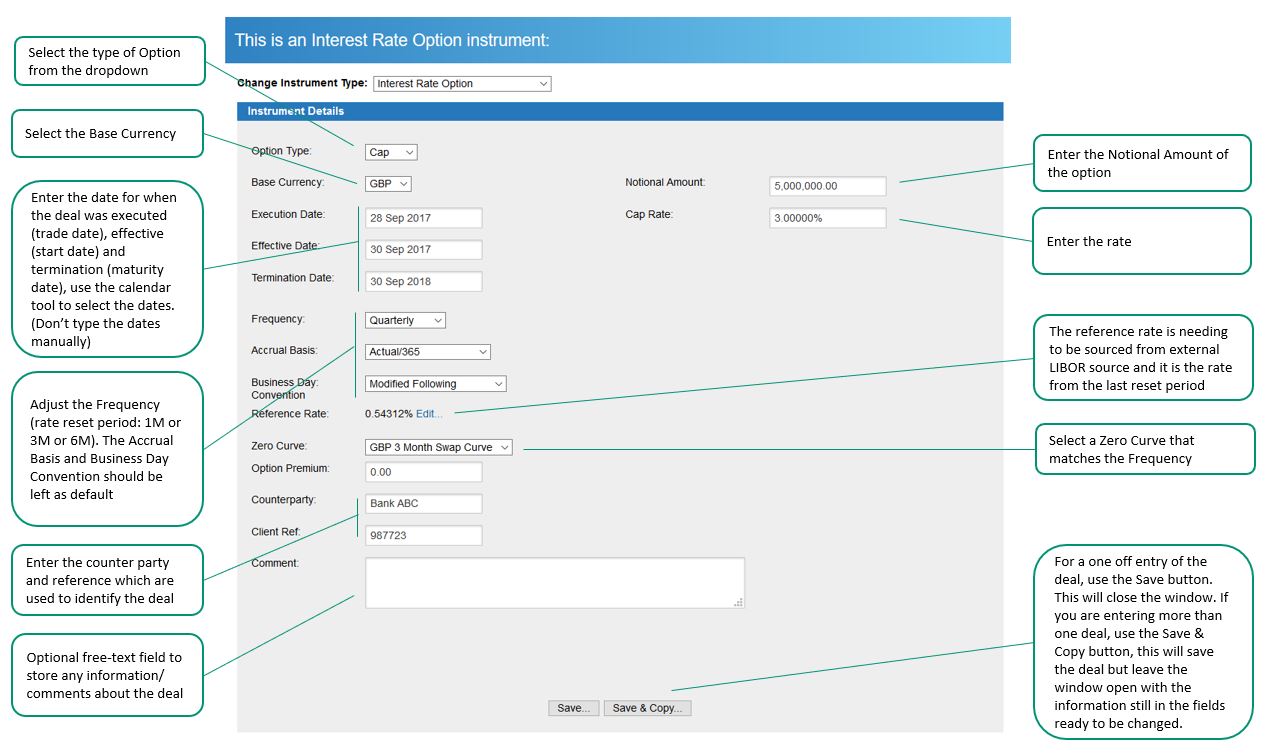

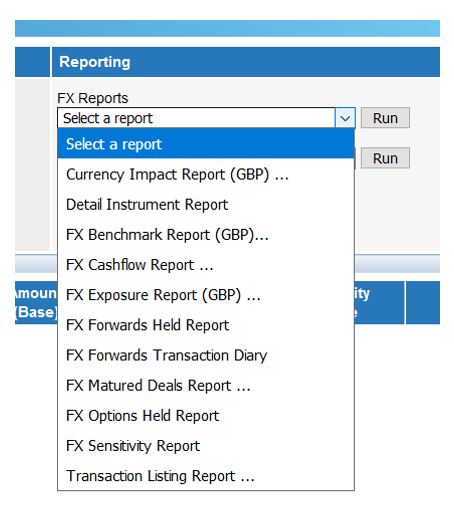

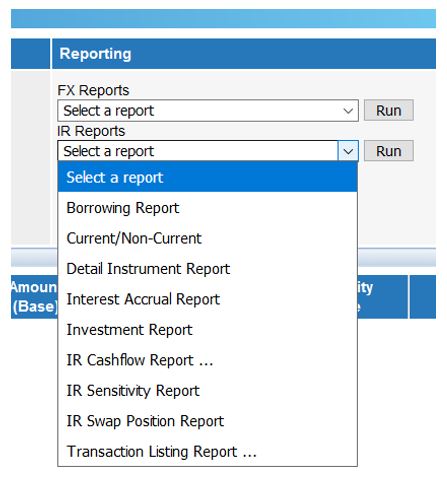

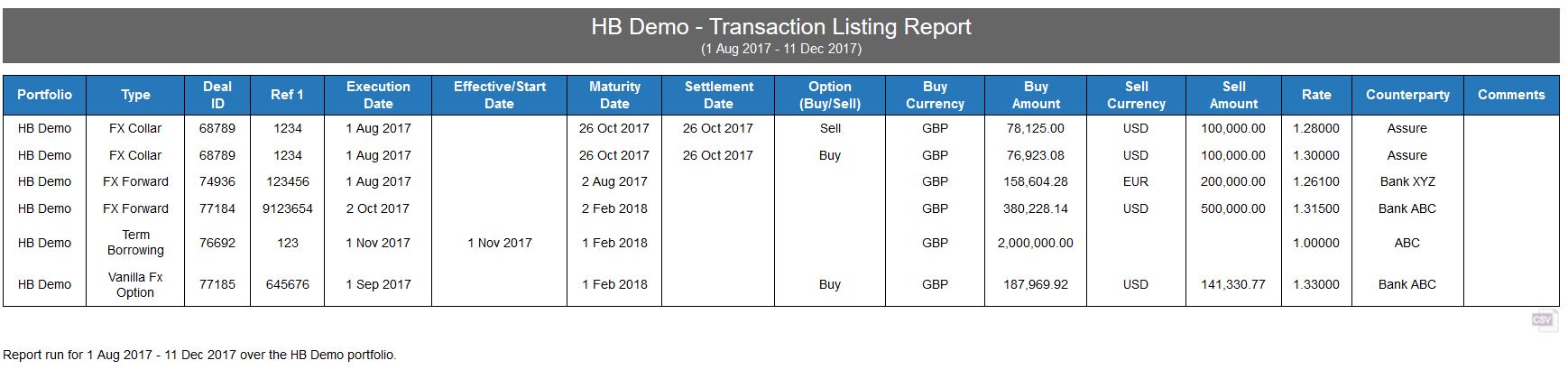

We have focused on the most commonly used financial instruments.

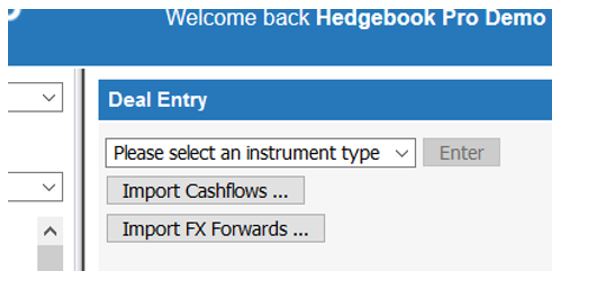

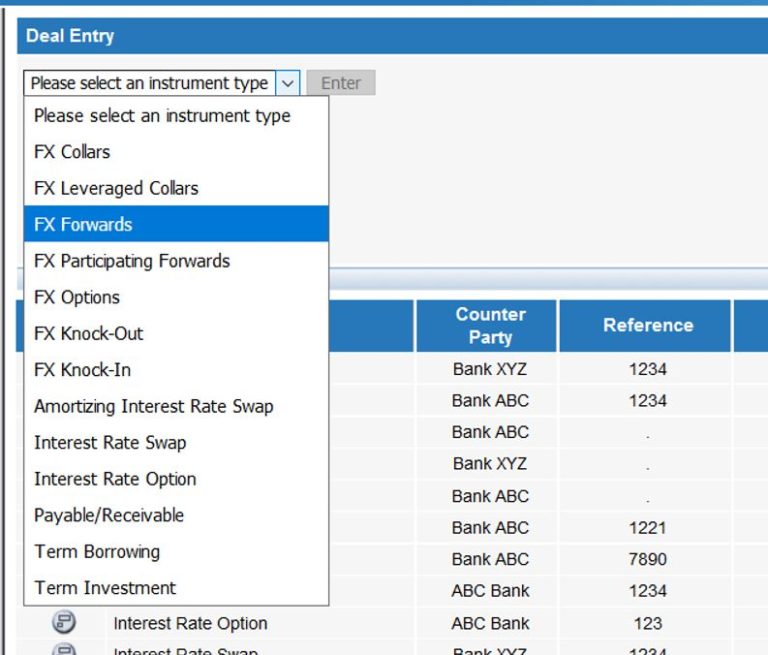

To enter a deal please select the appropriate one from the “Deal Input” dropdown me

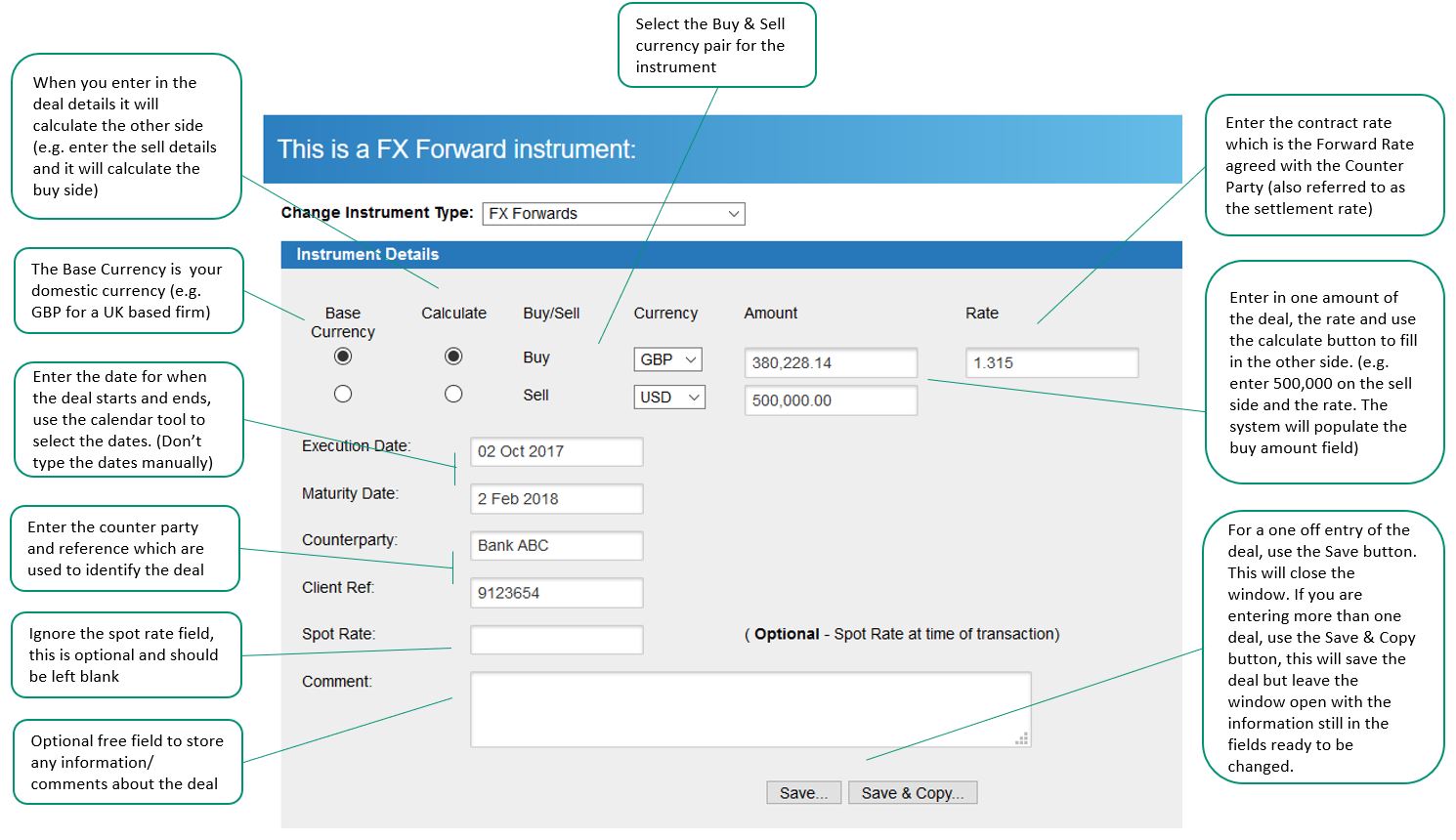

A step-by-step visual guide showing how to enter an FX Forward into Hedgebook. The video takes just over 2 minutes – if you need any further assistance please don’t hesitate to get in touch.

- From the Deal Input dropdown list, select FX Forwards

- Enter the details from bank confirmation

- Unless it is stated all fields must have something entered, if you don’t have a reference or counter party just enter in anything. The deal will not save if there are details missing.

N.B. bank confirmations are often worded from the bank’s perspective (e.g. “Bank Buys” equals “Sell Currency”)

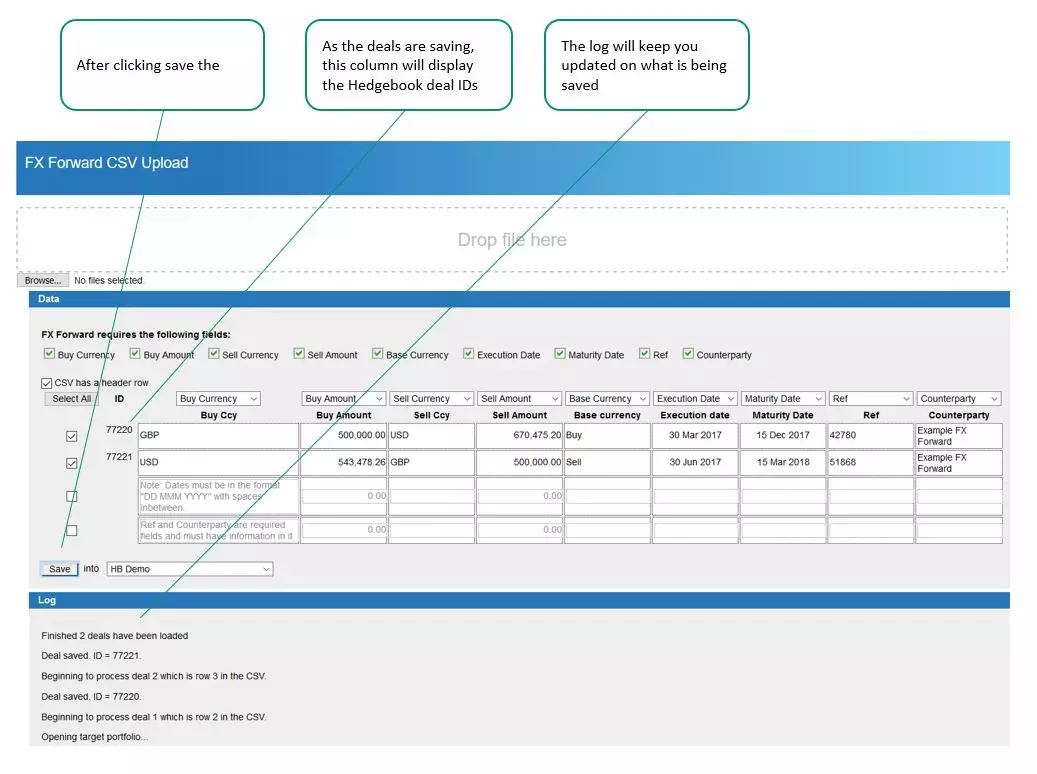

Discover how quick (and easy) it is to enter FX Forwards from a CSV spreadsheet into Hedgebook.

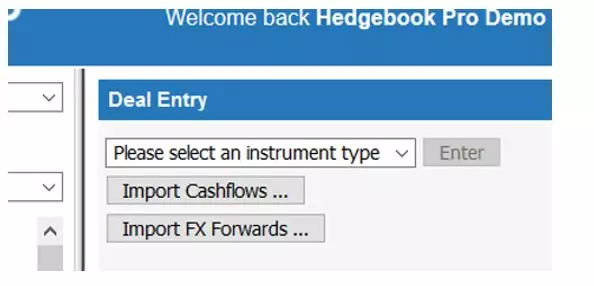

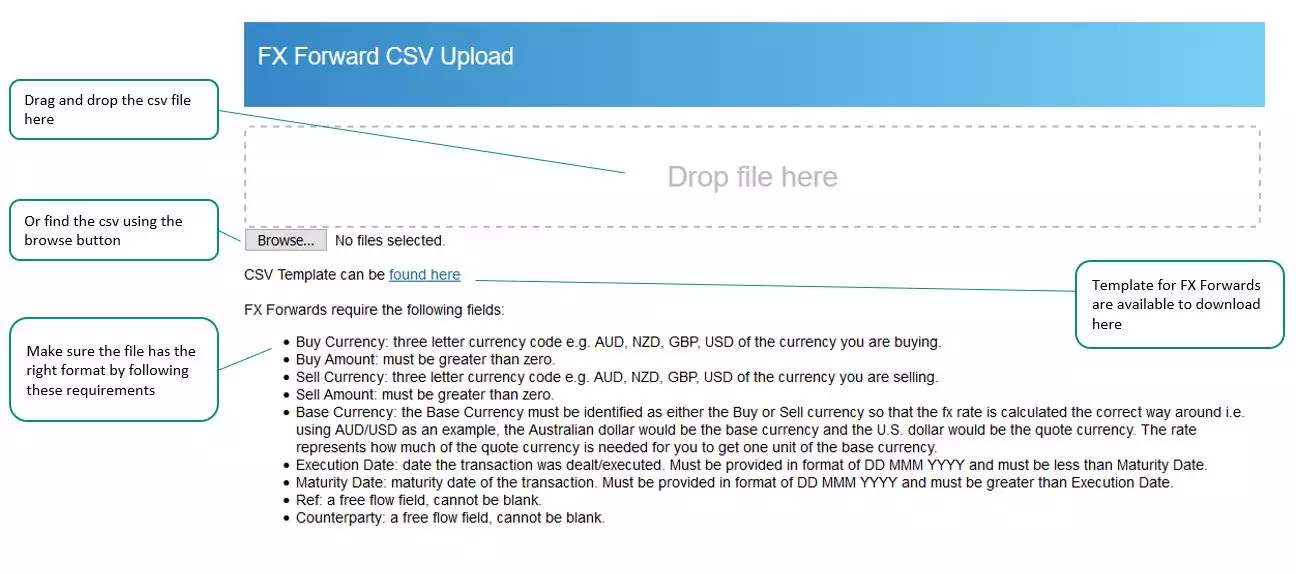

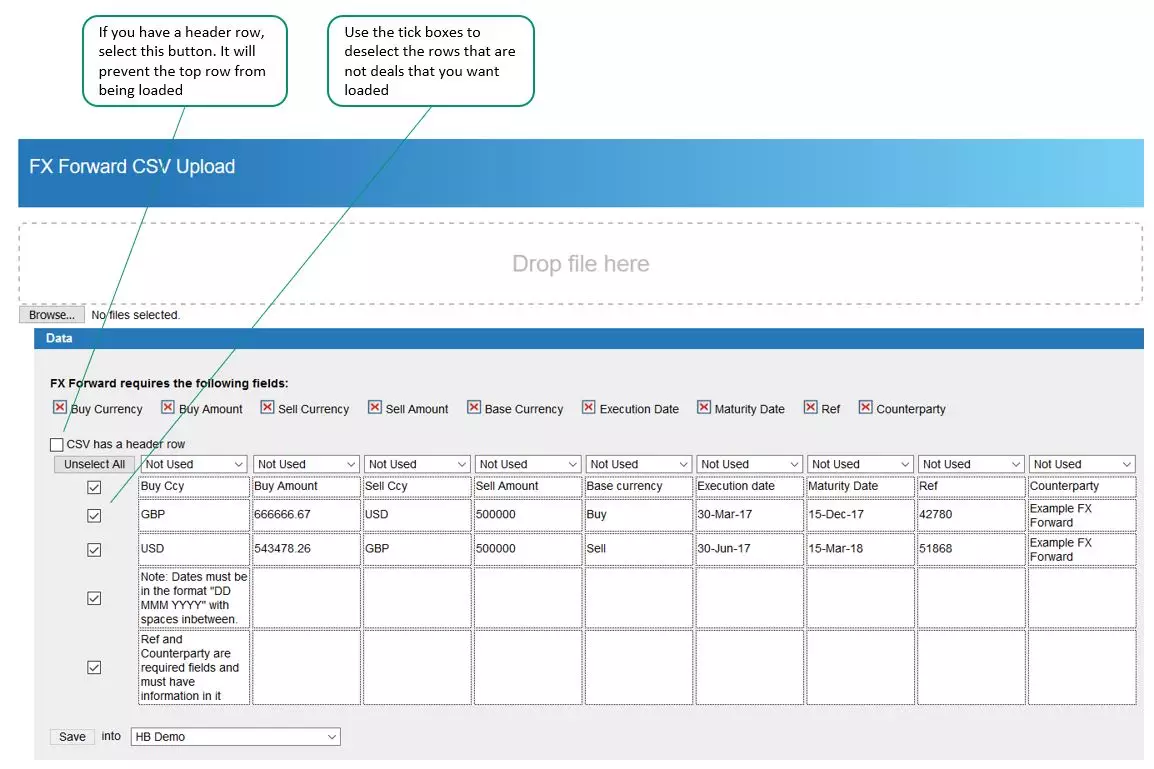

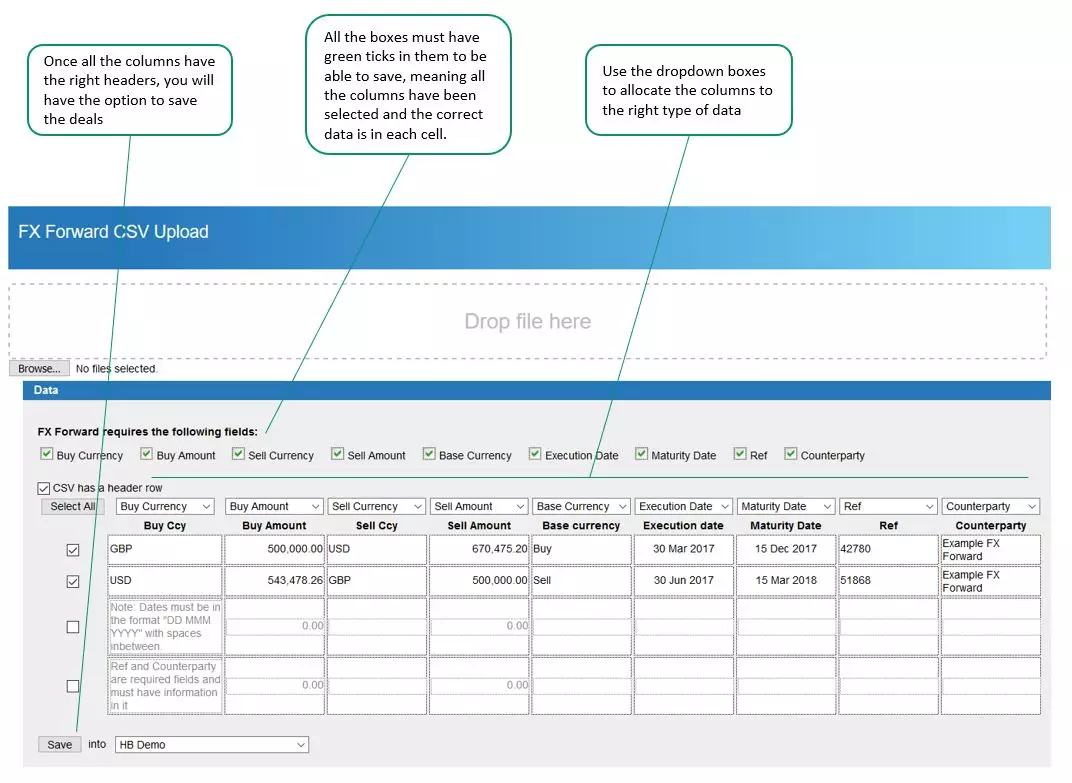

If you have FX Forwards you wish to load into Hedgebook that are in a spreadsheet you can use the CSV Importer by clicking on the “Import FX Forwards…” button

Make sure your CSV file is in the correct format, you can download a template from within the window.

Participating forwards are foreign exchange (FX) options providing a secured protected rate, while still allowing for beneficial currency moves. Learn how Hedgebook handles this in just a couple of minutes.

An FX collar involves buying a cap and selling a floor on the same currencies with the same expiration date. In just a couple of minutes we show you how to enter foreign exchange collars in Hedgebook.

An FX collar, also known as a hedge wrapper, is an options strategy implemented to protect against large losses, but it also limits large gains. Take a couple of minutes to learn how to enter FX leveraged collars into Hedgebook.

Learn how to use Trade Ideas in the FX Exposure Tool to get a clear view of your hedging position.

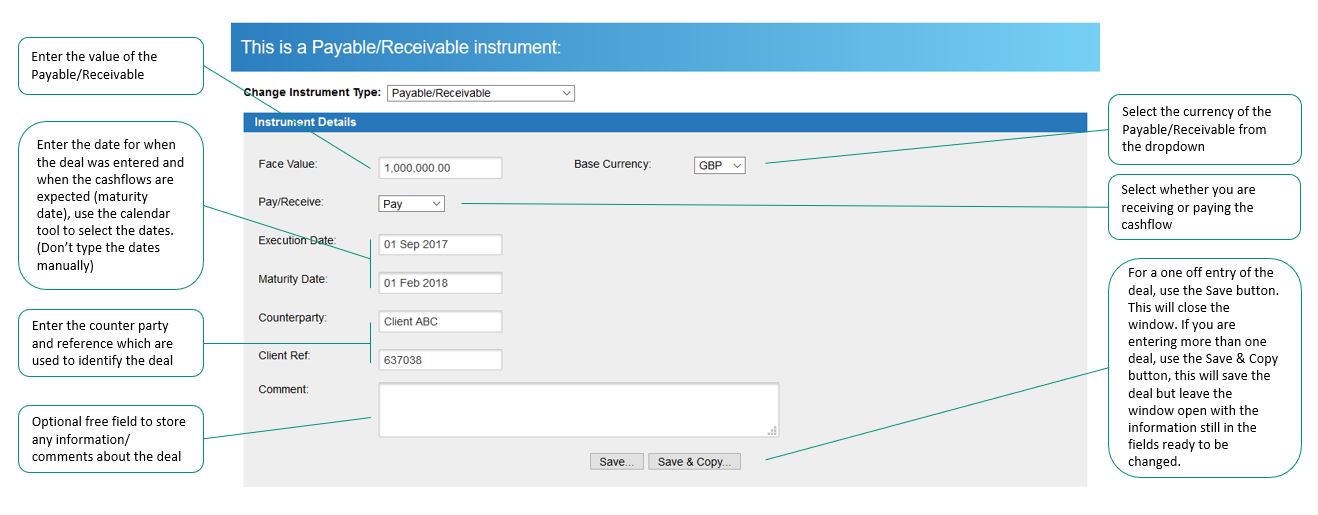

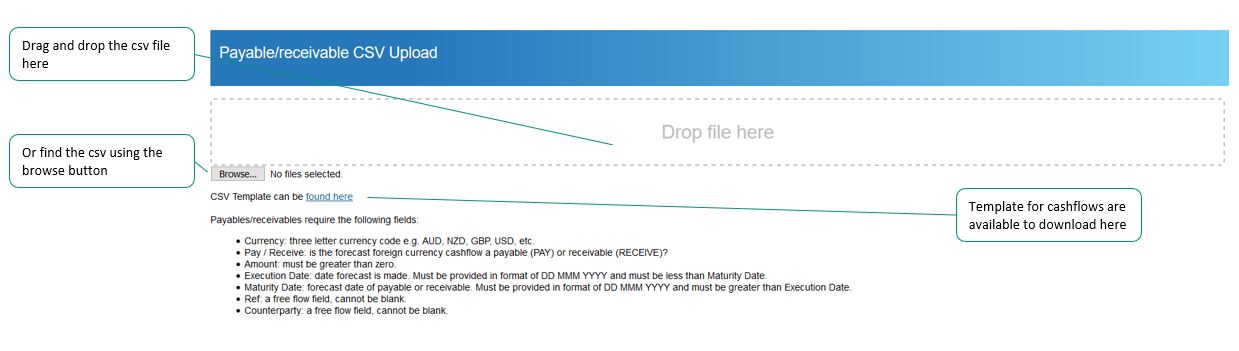

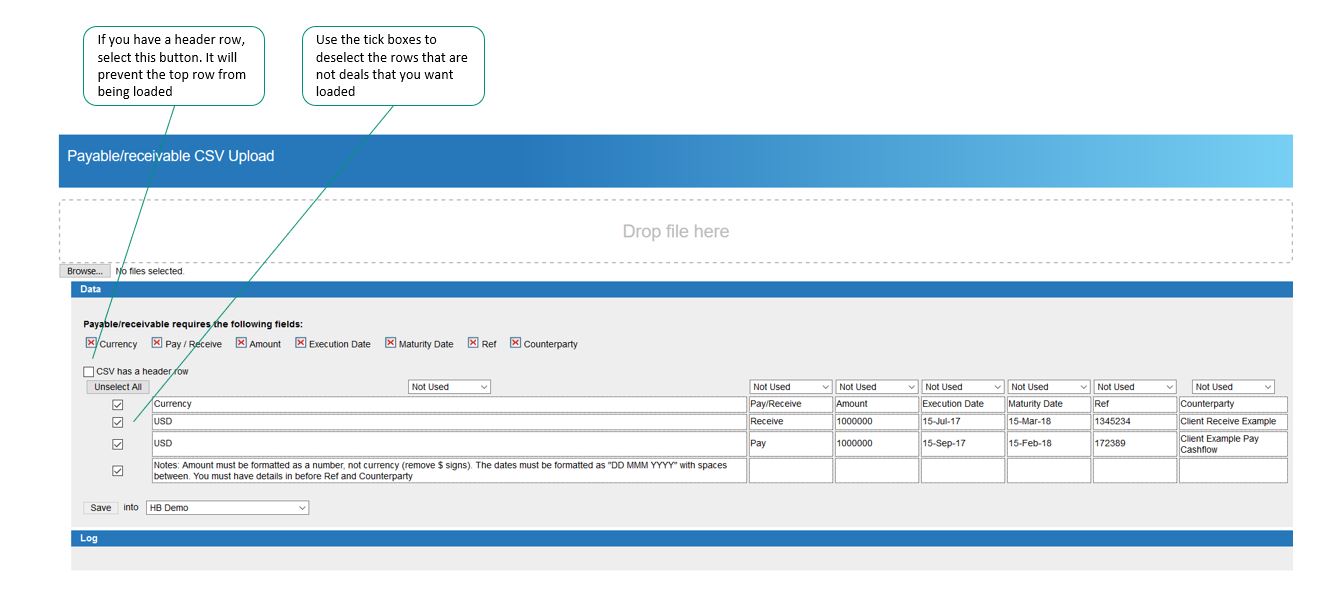

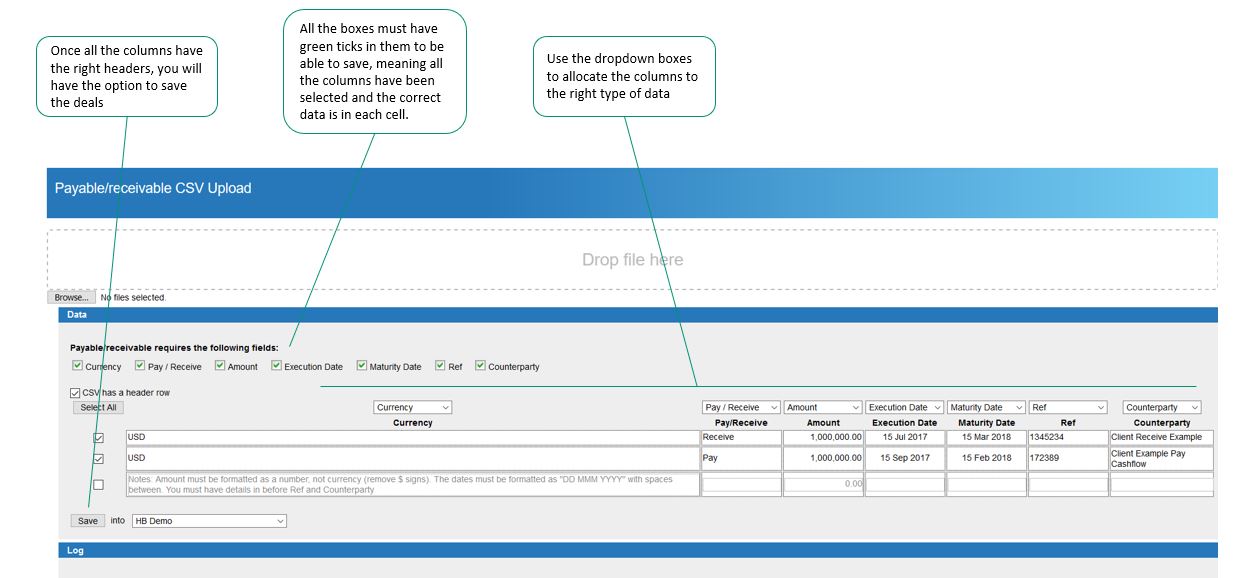

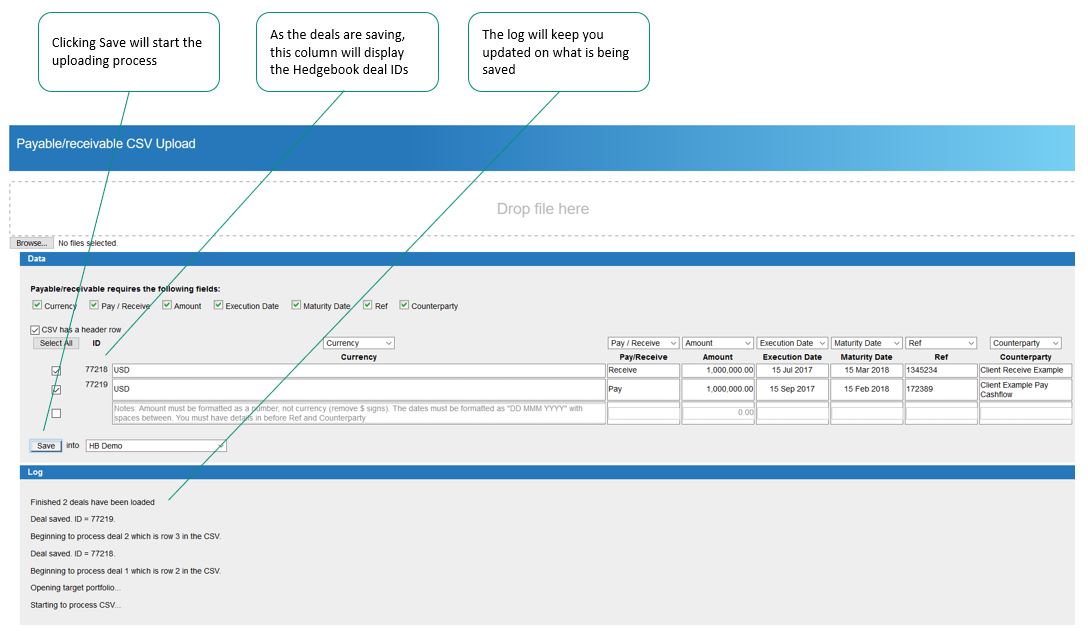

If you have multiple Payable/Receivables (Cashflows) you wish to load into Hedgebook the easiest way is to create a CSV file and load them via the CSV Importer by clicking on the “Import Cashflows…” button. A window will appear with more instructions.

To make sure your CSV file is in the correct format, you can download a template from within the window.

Interest rate help videos

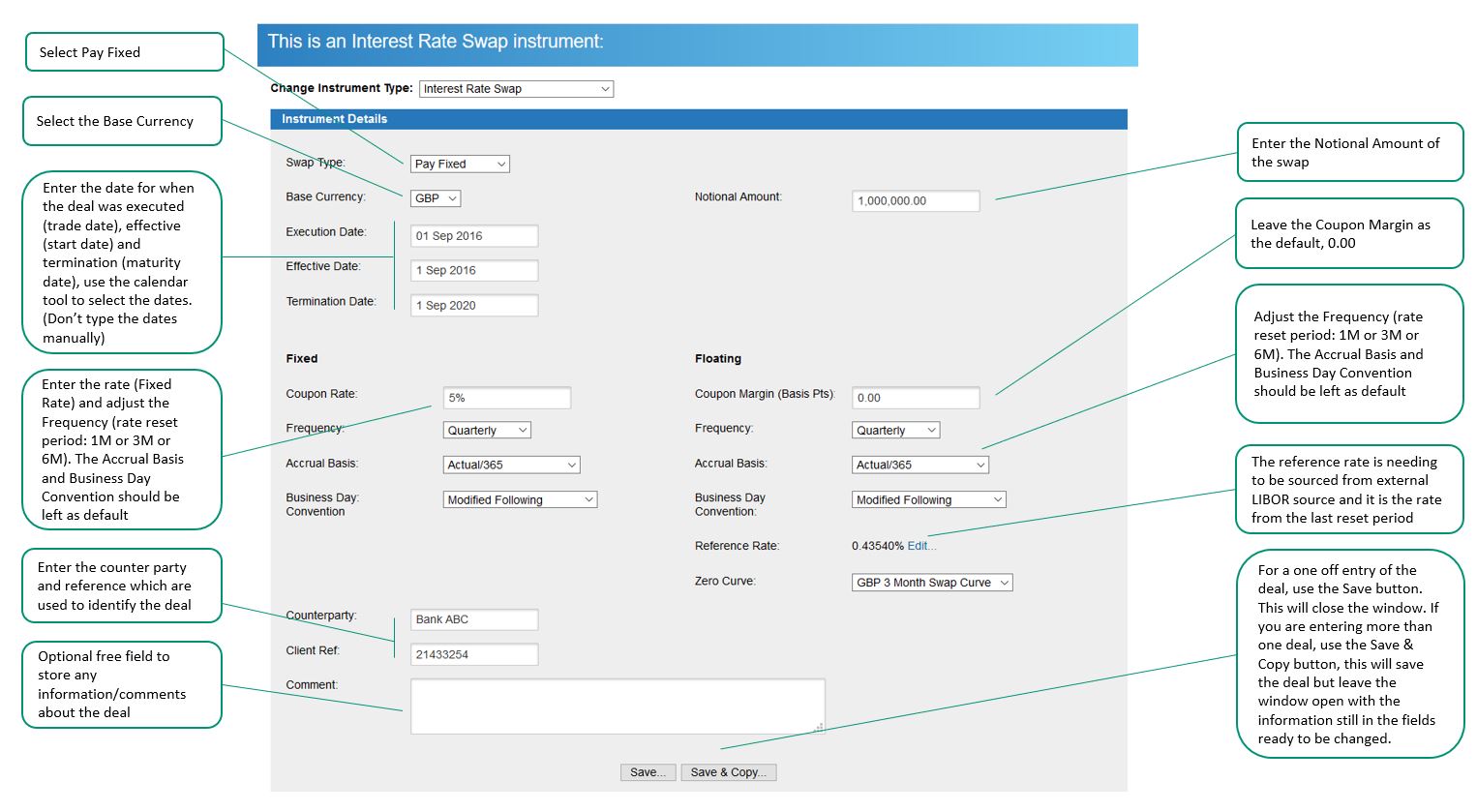

If you are unsure as to what an Interest Rate Swap is – then check out our explainer blog to learn more. The following video is a quick overview of how to enter an Interest Rate Swap into Hedgebook.

From the Deal Input dropdown list, select Interest Rate Swap. Unless it is stated all fields must have something entered, if you don’t have a reference or counter party just enter in anything. The deal will not save if there are details missing.

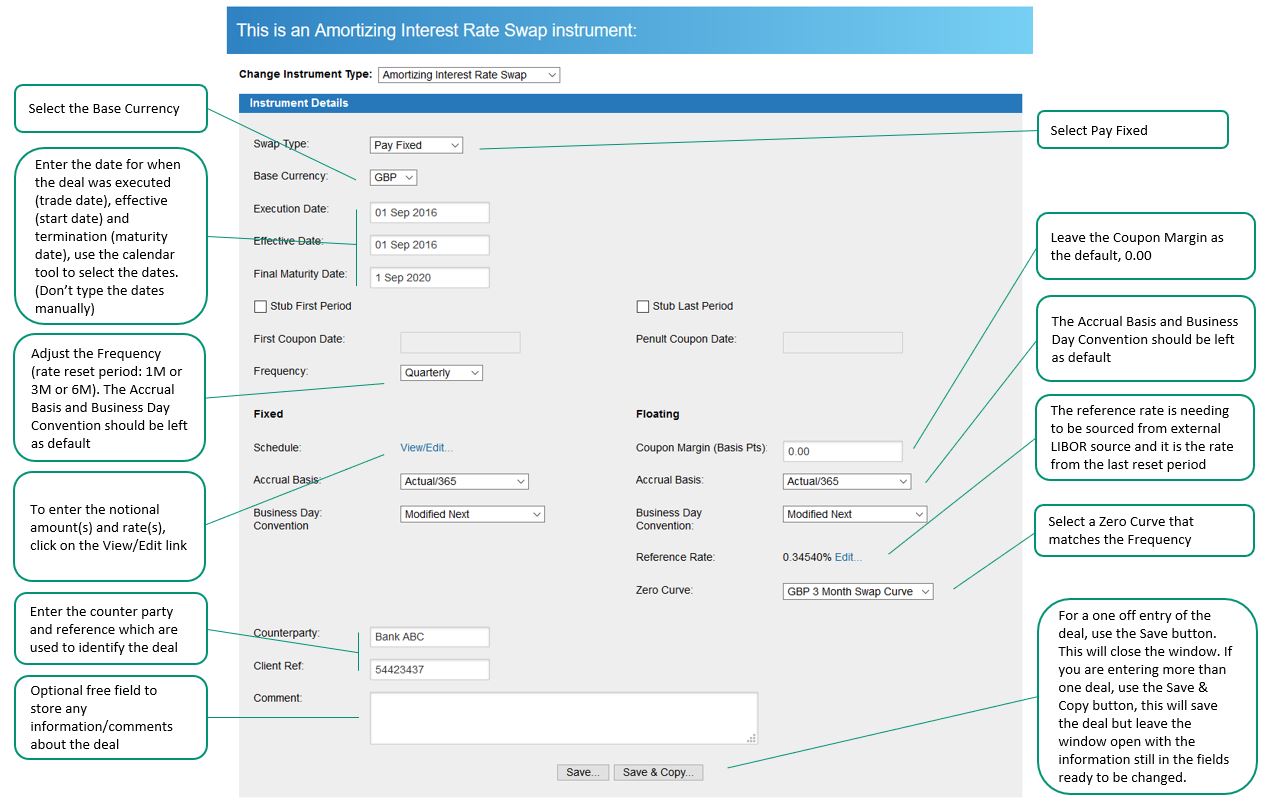

An amortizing swap is a derivative instrument in which one party pays a fixed rate of interest while the other pays a floating interest rate on a notional principal amount. Learn how to enter an Amortizing Interest Rate Swap into Hedgebook.

From the Deal Input dropdown list, select Amortizing Interest Rate Swap. Unless it is stated all fields must have something entered, if you don’t have a reference or counter party just enter in anything. The deal will not save if there are details missing.

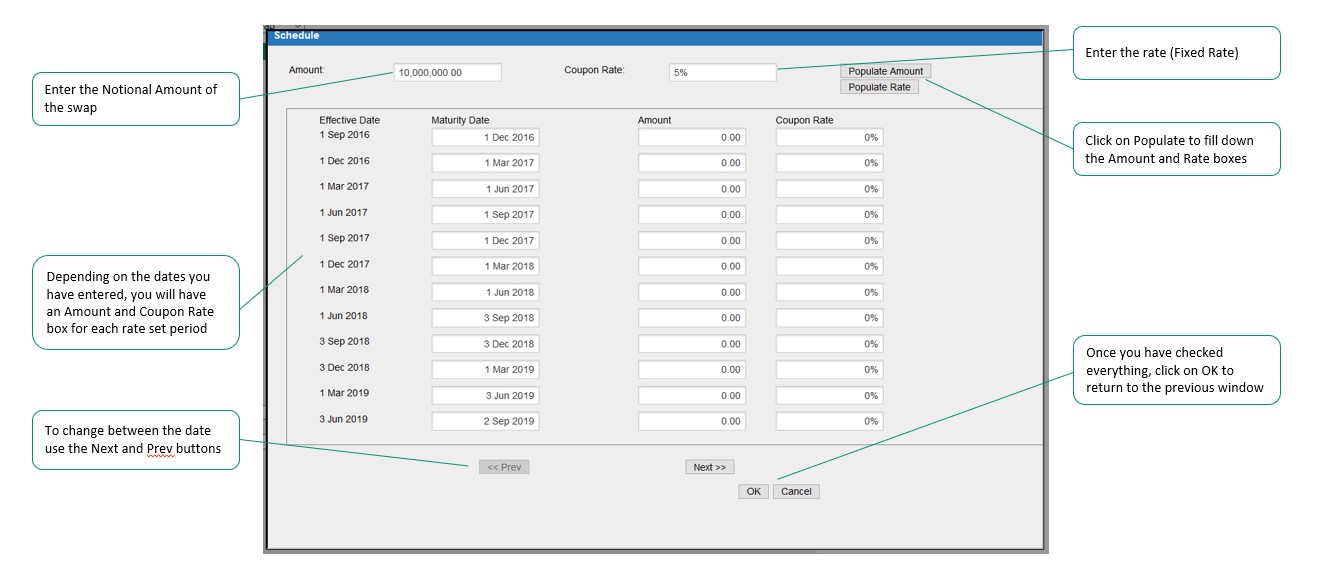

To enter the notional amounts and rates click on the Schedule link that opens the below window

You can access key functions for an individual deal via the Quick Edit icons that appear when the mouse pointer is hovered over the “View” icon. You can then access the following functions:

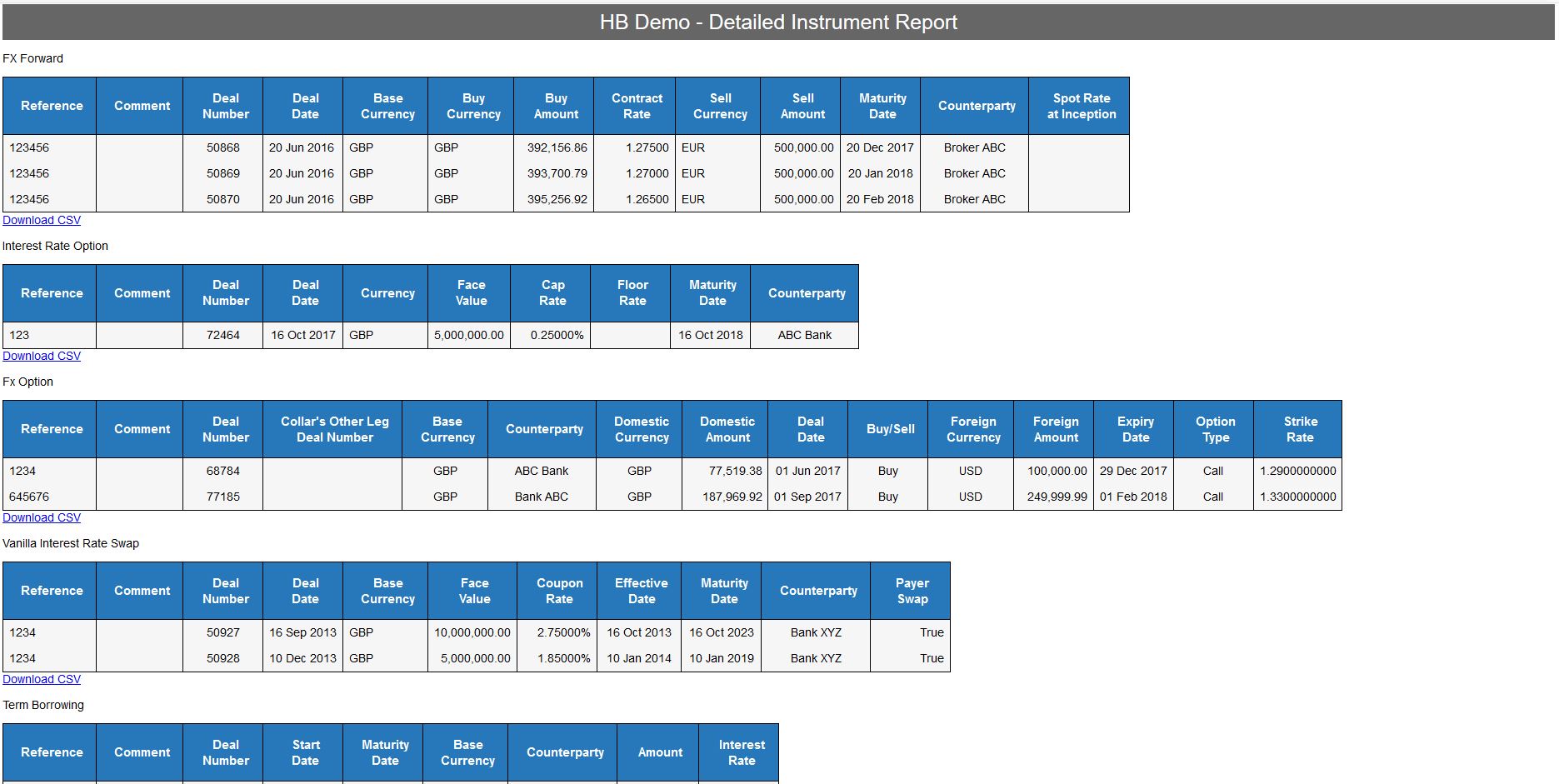

View the instruments parameters: ![]() This allows you to quickly view the deals basic parameters, including currency details, contract rates and amounts.

This allows you to quickly view the deals basic parameters, including currency details, contract rates and amounts.

View in more detail: ![]() This allows you to view the deals basic parameters, as well as it’s mark-to-market valuation for a given date, and the metrics used to calculate that valuation. Please note that to see this the deal must first be valued using the “Value Now” button”

This allows you to view the deals basic parameters, as well as it’s mark-to-market valuation for a given date, and the metrics used to calculate that valuation. Please note that to see this the deal must first be valued using the “Value Now” button”

Edit instrument details: ![]() Use this tool if you wish to change the details for a particular deal previously entered.

Use this tool if you wish to change the details for a particular deal previously entered.

Move to trash: ![]() Deletes the selected deal from the database. Please note, there is no “undo” for this action.

Deletes the selected deal from the database. Please note, there is no “undo” for this action.

Move to another portfolio: ![]() Select this tool to move the highlighted deal to another portfolio you have associated to your account.

Select this tool to move the highlighted deal to another portfolio you have associated to your account.

Pre delivery and extension wizard: ![]() (FX Forward Only) Not relevant to Audit – provides the option to pre deliver or extend part or all of an outstanding deal.

(FX Forward Only) Not relevant to Audit – provides the option to pre deliver or extend part or all of an outstanding deal.

FX Life Cycle Report: ![]() (FX Forward Only) Not relevant to Audit – it is a report to show you the life of an FX Forward.

(FX Forward Only) Not relevant to Audit – it is a report to show you the life of an FX Forward.

Cash-flow Map: ![]() (Interest Rate Instruments Only) – it is a report that shows you the cashflows of the swap over its life. Note: you must value the swap first

(Interest Rate Instruments Only) – it is a report that shows you the cashflows of the swap over its life. Note: you must value the swap first

With the transition away from LIBOR, here is a “how to” video to value interest rate swaps using SONIA (for GBP) and SOFR (for USD).

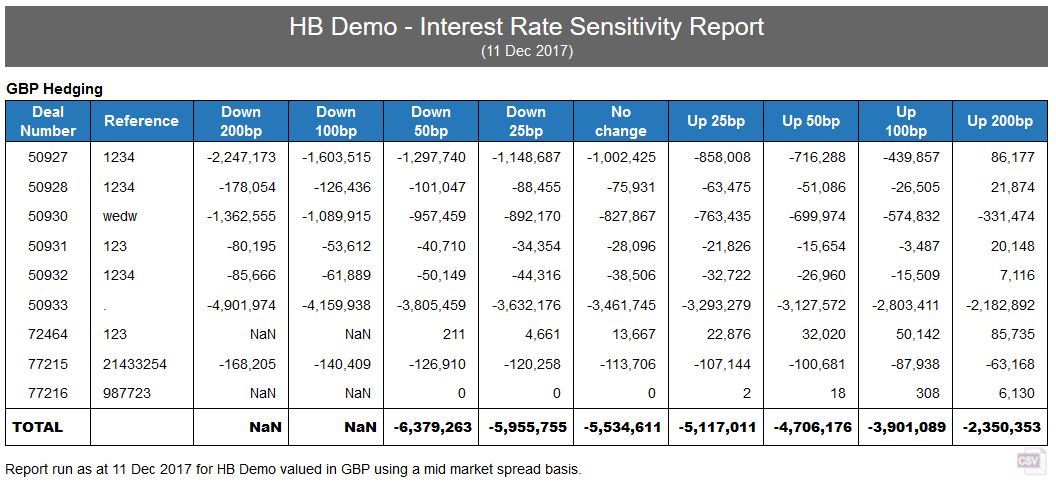

Helps finance teams present key interest rate data in a visually compelling way. Often the information will be used for treasury management reporting purposes. It can be used to create trade ideas (hedging strategies) and measure the impact of hypothetical interest rate scenarios on your overall interest rates and costs.

Use Hedgebook to capture bank debt facilities plus any other sources of funding e.g. bonds, placed through debt capital markets. It gives you visuals of :

- your debt funding maturity profile

- percentage split across counterparties

- facility usage of drawn versus undrawn funds.

You can provide core debt to drive interest rate hedging decisions and ‘forecast debt’to understand interest cost outcomes. If you include your minimum and maximum risk control limits you immediately can identify areas that don’t comply.

See this in action:

General help videos

Literally take a minute to learn how to delete single and multiple instruments in Hedgebook.

Ooops. You’ve forgotten your password. Don’t panic. Follow this quick guide to how to reset your password and regain secure access to Hedgebook.

Learn how to capture and manage ‘Order to Buy’ transactions.

How to capture foreign currency exposures using the Cashflow Forecast instrument.

A two minute overview of Hedgebook’s Exposure Tool for understanding your FX risk position.

Discover how to add budget rates into Hedgebook’s FX Exposure Tool.

If you have multiple portfolios you can manage them in a single view then report against them individually.

See how it works: