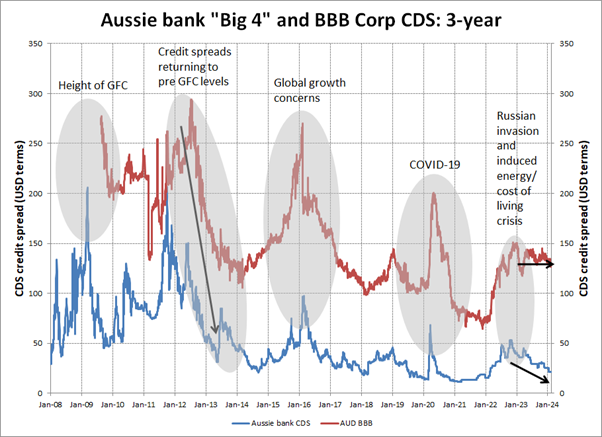

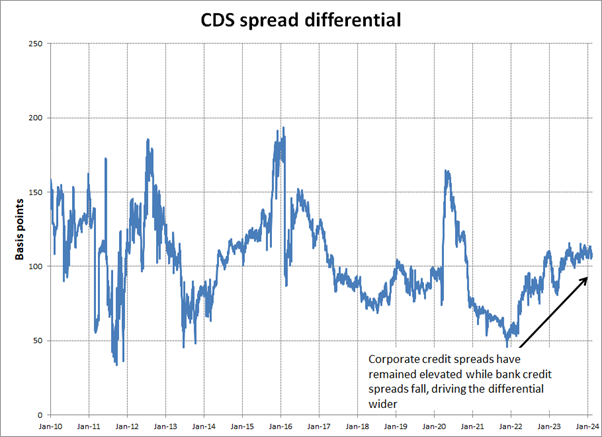

There is certainly nothing new in fluctuating credit conditions and the impact CVA/DVA regulations have had on reporting. The chart below looks back at Australian bank and corporate credit spreads over the last 15 years. The overall trend has been downwards with spikes every three to four years or so. In the last 12 months we have seen a return to that downward trend for banks but not so much for corporates. So, what does this mean for the materiality of CVA/DVA and adjustments at financial year-end?

First, some history. The introduction of IFRS 13 in January 2013 was, in part, recognition of the mispricing of market credit risk that had resulted in the near collapse of financial markets in 2008.

IFRS 13 requires “fair value” to include a credit adjustment for financial instruments such as FX forwards, FX options and interest rate swaps representing the credit worthiness of each counterparty to the transaction.

It made sense to adjust valuations by a credit component. IFRS 13 bases ‘fair value’ on an ‘exit price’ of the security i.e. the price at which you can go to the bank and close out an existing transaction. Whether you are buying or selling a financial instrument the bank naturally adds a margin so it is counter-intuitive to mark-to-market a position without a credit component.

Lack of auditor engagement in materiality of CVA/DVA

What was most surprising about the introduction of IFRS 13 was the initial lack of engagement by auditors to champion the credit adjustment component of valuations.

Lack of materiality was often cited as the reason for not asking companies to provide the credit adjustment when put in context of other risks within the business. But it was hard to see how the adjustment could be deemed non-material if the calculation was never done.

By 2016 the deterioration of credit conditions was again raising a flag to see if auditors continued to stand-by the “non-material” argument or whether there is a move towards compliance of the IFRS 13 accounting standard.

In our experience, very little has changed from an auditor perspective. There remains a general malaise and lack of enforcement of companies to report CVA/DVA. However, for those corporates that do, they will find that their positive CVA adjustment for in-the-money positions will have declined as bank credit spreads have tightened, while their negative DVA adjustment for out-of-the-money positions will be relatively unchanged.

For a demo of Hedgebook’s CVA/DVA functionality, simply let us know your interest..