When we first took a look at end-of-year derivative valuations back in 2013 borrower derivatives such as interest rate swaps looked much healthier compared to the previous year. However, the reaction of the financial markets to the global pandemic over the last 12 months has seen interest rates decline sharply. As governments created policy on the hoof to protect businesses and jobs, the associated costs and economic upheaval has meant markets expect interest rates to be lower for longer.

‘Pay fixed interest rate’ swaps feel pain at year-end

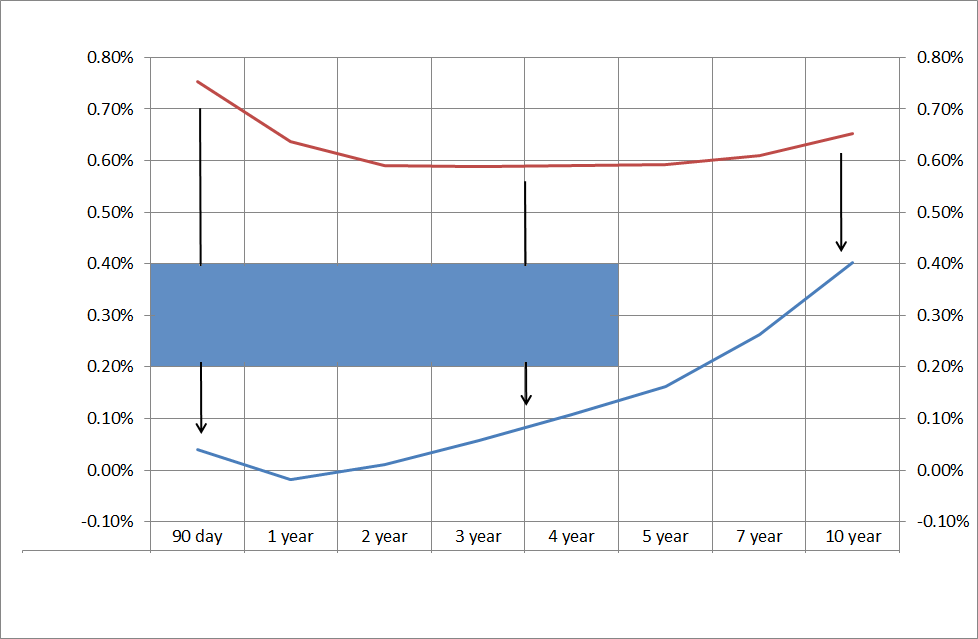

Of the seven currencies that are included in the charts below, all display decreases across the curve, to varying degrees. EUR and JPY interest rates have fallen less as they were already in the unique negative interest rate paradigm.

Many businesses hedge their debt using pay fixed interest rate swaps. This is either as a condition of the bank lending them money, or adherence to internal risk control limits when managing interest rate risk. Pay fixed swaps are used to create certainty around the costs of servicing the debt and protecting the business from higher interest rates.

However, there are unrealised losses if the interest rates are lower than when the interest rate swap was originally transacted. Interest rate swaps are often a multi-year commitment so the decrease in interest rates over 2020 means many ‘pay fixed interest rate swaps’ will have a mark-to-market significantly lower when compared to a year ago.

An interest rate swap effectively ‘swaps’ fixed cashflows for floating cashflows. From a borrower’s perspective this means pay fixed/receive floating. It is the ‘receive floating’ leg of the equation that has negatively impacted valuations as these are expected to be less over the life of the swap than was the case 12 months ago.

Many CFOs disappointed in derivative valuations

As year-end Financial Statements are completed there will be many CFOs disappointed to see the change with regards to the revaluation of borrower derivatives. Auditors should not be surprised to see substantial negative mark-to-market movements as they complete the financial instrument component of the audit engagement. Comparing Hedgebook’s cashflow map from one year to the next provides supporting information around these revaluation movements.

What about next year? Well given the colossal amount of government debt required to fund the economic recovery then it is reasonable to expect interest rates to move higher. Investors require compensation to absorb the increased supply of debt and we are already seeing this playing out in global interest rate markets.