Corporate Treasurers and Finance Directors have spoken out about the challenge of managing risk, on outdated and expensive systems. It comes as their department is thrust to the forefront of managing the fallout of Covid-19. Working from home has its but for those relying on systems that aren’t built for collaboration, the tyranny of distance can result in costly errors. To meet this challenge, we’ve identified six key areas where Hedgebook helps a corporate hedge smarter and better manage FX risk.

1. You need a single source of truth

Hedgebook’s cloud-based system is available anywhere, anytime. Corporate users can be permissioned depending on their function with oversight provided by management. Most importantly, reporting is designed with the modern, corporate, finance department in mind and is available at the click of a button.

Want to see how far in or out of the money your outstanding FX forwards are? Simply log on and run the ‘forwards held’ report. Unsure when your next hedge requires settling? Run the ‘upcoming deals’ report or receive an alert.

An easily accessed, single source of truth is a minimum requirement when hedging in the current environment.

2. Keep costs down, and confidence up

Important at the best of times, cost management is critical today. Some companies need to pay thousands of pounds, dollars (or your local equivalent) for a Treasury Management System that does everything but make coffee. Many don’t deliver on their promise.

Hedgebook has been designed to provide a cost- effective solution for companies looking to have better visibility over their hedging and cashflow while ticking off audit requirements. Many of our global clients – such as fashion retailer Kathmandu, have migrated to Hedgebook from other TMSs. According to Chris Kinraid, Kathmandu’s Group Financial Controller:

“Hedgebook gives us all the functionality we need to capture, value and report our treasury exposures at a fraction of the cost.”

What could be more straightforward than doing the same job at a better price point?

3. Drive better quality engagement with banks, brokers and advisors

The ease of sharing information on Hedgebook’s cloud technology helps many of our clients drive more constructive conversations with their bank and broker. 91% of respondents in our most recent client survey told us they would consider integrating more deeply with their bank or broker through Hedgebook in order to improve the efficiency and quality of decision making.

4. Spend less time on compliance and administration

Compliance and administration is generally filed into the “boring, but necessary” category. But we all know how important it is. Financial reporting ensures transparency and there’s no getting away from the fact that we operate in an environment of increased regulation.

While independent valuations and sensitivity reporting requirements are not going away, Hedgebook removes much of the pain in obtaining them.

Achieving the appropriate level of compliance while relying on banks and spreadsheets is time consuming. It also takes much of an organisation’s talent away from the primary goal of delivering profit. Hedgebook automatically ticks the compliance boxes and makes the administration of managing your hedges and exposures easy.

5. Evaluate performance – helping a corporate hedge smarter

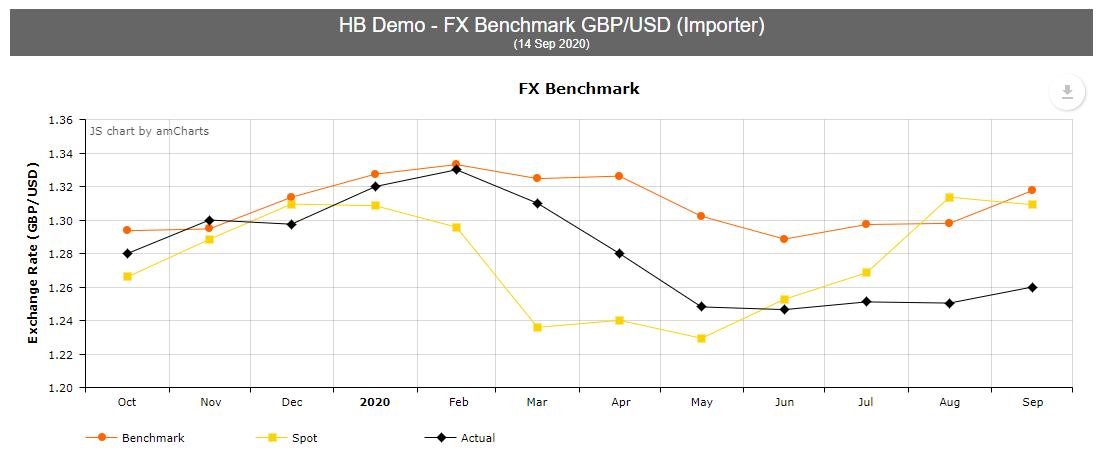

Reviewing the performance of past FX hedging helps make better future hedging decisions. Hedgebook’s benchmark report uses delivered contracts to determine an “actual” rate achieved and clearly demonstrates the impact of outcomes against a “no hedging” approach. While the results will not always be favourable, every Board wants to know the impact of past decisions made:

Combine this with Hedgebook’s advanced FX hedging visuals, plus good support from your trading partner, and you will be well positioned to protect profitability into the future.

6. Easy to set up? Simple.

In most cases Hedgebook can be set up within 24 hours with little work on your part. It is in a secure cloud so there is no limitations around your location or when and how you decide to access it. We will gladly walk you through what’s involved so you can see for yourself how quick and easy it can be to set up a cost-effective and scalable system that delivers visibility over cash flow and hedging.

So there you have it. Six ways in which Hedgebook can help you and your corporate team hedge smarter and more cost effectively. To get things started simply get in touch and we will connect you with one of our technical experts. We promise they’ll keep the jargon to a minimum.