The purpose of this blog is to examine IFRS 13 as it relates to the Credit Value Adjustment (CVA) of a financial instrument. In the post GFC environment, greater focus has been given to the impact of counterparty credit risk. IFRS 13 requires the valuation of counterparty credit risk to be quantified and separated from the risk-free valuation of the financial instrument. There are two broad methodologies that can be considered for calculating CVA: simple and complex. For a number of pragmatic reasons, when considering the appropriate methodology for corporates, the preference is for a simple methodology to be used, the rationale for which is set out below.

IFRS 13 objectives

Before considering CVA it is worthwhile re-capping the objectives of IFRS 13. The objectives are to provide:

– greater clarity on the definition of fair value

– the framework for measuring fair value

– the disclosures required about fair value measurements.

Importantly, from a CVA perspective, IFRS 13 requires the fair value of a liability/asset to take into account the effect of credit risk, including an entity’s own credit risk. The notion of counterparty credit risk is defined by the risk that a party to a financial contract will fail to fulfil their side of the contractual agreement.

Factors that influence credit risk

When considering credit risk there are a number of factors that can influence the valuation including:

– time: the longer to the maturity date the greater the risk of default

– the instrument: a forward exchange contract or a vanilla interest rate swap will carry less credit risk than a cross currency swap due to the exchange of principal at maturity

– collateral: if collateral is posted over the life of a financial instrument then counterparty credit risk is reduced

– netting: if counterparty credit risk can be netted through a netting arrangement with the counterparty i.e. out-of-the money valuations are netted with in-the-money valuations overall exposure is reduced

CVA calculation: simple versus complex

There are two generally accepted methodologies when considering the calculation of CVA with each having advantages and disadvantages.

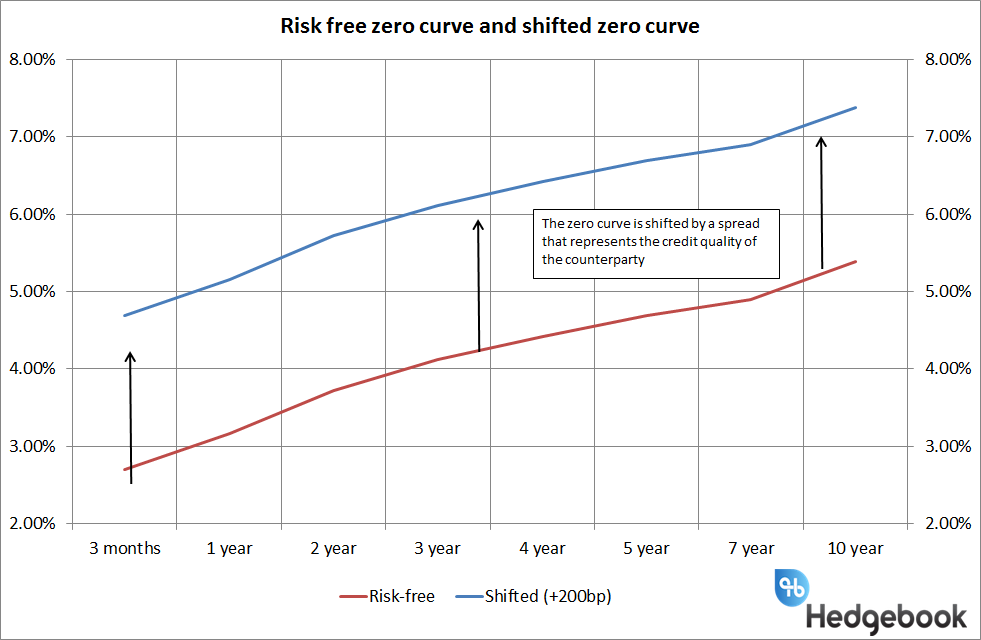

The simple methodology is a current exposure model whereby the Net Present Value (NPV) of the future cashflows of the financial instrument on a risk-free basis is compared to the NPV following the inclusion of a credit spread. The difference between the two NPVs is CVA. The zero curve for discounting purposes is simply shifted by an appropriate credit spread such as that implied by observable credit default swaps.

To give a sense of materiality, a NZD10 million swap at a pay fixed rate of 4.00{f7bf280756c7962f36c8149e0d9ee88f562c5d99257c2c5bf9624184485b6cda} with five years to maturity has a positive mark-to-market of +NZD250,215 based on the risk-free zero curve (swaps). Using a 200 basis point spread to represent the credit quality of the bank/counterparty the mark-to-market reduces to +NZD232,377. The difference of -NZD17,838 is the CVA adjustment. The difference expressed in annual basis point terms is approximately 3.5 bp i.e. relatively immaterial. In the example we have used an arbitrary +200 bp as the credit spread used to shift the zero curve. In reality the observable credit default swap market for the counterparty at valuation date would be used.

The advantages of the simple methodology is it is easy to calculate and easy to explain/demonstrate. The disadvantage of the simple methodology is takes no account of volatility or that a position can move between being an asset and a liability as determined by the outlook for interest rates/foreign exchange.

The complex methodology is a potential future exposure model and takes account of factors such as volatility (i.e. what the instrument may be worth in the future through Monte Carlo simulation), likelihood of counterparty defaulting (default probability) and how much may be recovered in the event of default (recovery rate). The models used under a complex methodology are by their nature harder to explain, harder to understand and less transparent (black box). Arguably the complex methodology is unnecessary for “less sophisticated” market participants such as corporate borrowers using vanilla products, but more appropriate for market participants such as banks.

Fit for purpose

An important consideration of the appropriate methodology is the nature of the reporting entity. For example, a small to medium sized corporate with a portfolio of vanilla interest rate swaps or Forward Exchange Contracts (FECs) should not require the same level of sophistication in calculating CVA as a large organisation that is funding in overseas markets and entering complex derivatives such as cross currency swaps. Cross currency swaps are a credit intensive instrument and as such the CVA component can be material.

Valuation techniques

Fair value measurement requires an entity to explain the appropriate valuation techniques used to measure fair value. The valuation techniques used should maximise the use of relevant observable inputs and minimise unobservable inputs. Those inputs should be consistent with the inputs a market participant would use when pricing the asset or liability. In other words, the reporting entity needs to be able to explain the models and inputs/assumptions used to calculate the fair value of a financial instrument including the CVA component. Explaining the valuations of derivatives including the CVA component is not a straightforward process, however, it is relatively easier under the simple methodology.

Summary

IFRS 13 requires financial instruments to be fair valued and provides much greater guidance on definitions, frameworks and disclosures. There is a requirement to calculate the credit component of a financial instrument and two generally accepted methodologies are available. For market participants such as banks, or sophisticated borrowers funding offshore and using cross currency swaps, there is a strong argument for applying the complex methodology. However, for the less sophisticated user of financial instruments such as borrowers using vanilla interest rate swaps or FECs then an easily explainable methodology that simply discounts future cashflows using a zero curve that is shifted by an appropriate margin that represents the counterparty’s credit should suffice.