We have a identified a common difficulty many companies face when using path dependent options, such as leveraged collars or participating forwards. The issue is being able to predict the amount of cover in place under different market conditions.

Let’s look at an example:

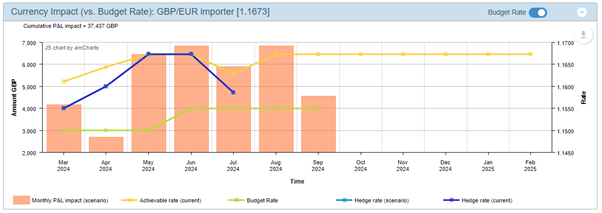

- UK based importer hedging EURpayments

- FX product = leveraged collar

- Leverage ratio = 2 for 1

- Protection amount = EUR250,000

- Participation amount = EUR500,000

- Expiry = three months

- Protection rate = 1.1600

- Participation rate = 1.1700

What are the possible outcomes?

The spot rate at the expiry date of the leveraged collar will impact the amount of cover if the spot rate is:

- Less favourable than the protection rate (i.e. lower than 1.1600 in this example) the hedged amount will be EUR250,000 at the protection rate.

- More favourable than the participation rate (i.e. higher than 1.1700 in this example) the hedged amount will be EUR500,000 at the participation rate.

- In between the protection and participation rates there is no obligation to transact.

Therefore, depending on where the spot rate is at expiry, the importer could end up with EUR250,000 at 1.1600 or EUR500,000 at 1.1700 (or zero if in between the protection and participation rates). The primary reason for entering this type of hedging instrument is to improve the protection and/or participation rate than could otherwise be achieved without leverage.

Risk Management

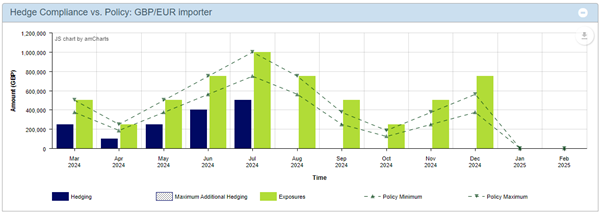

From a risk management perspective, the company hedging their foreign currency cashflows needs to understand the impact alternative scenarios can have on hedging cover, both amount and rate. Often there are policy limits to adhere to, so having visibility over these, and ensuring limits are not broken, is important.

Hedgebook Reports

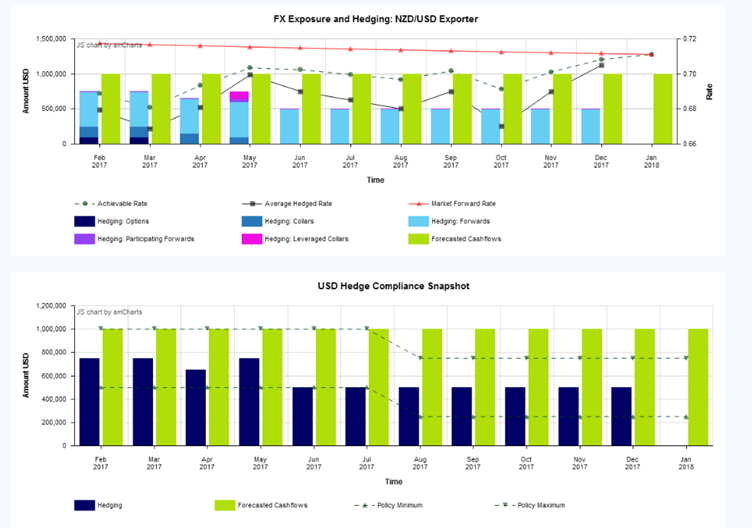

The FX Exposure Tool in Hedgebook gives the user visibility over their hedge position under alternative outcomes. Hedging percentages, weighted average hedged rates and policy compliance under various hypothetical market conditions can easily be compared. You can see exactly how this works in a quick overview demo here.

Hedgebook gives users of structured options confidence these complex instruments are being recorded, valued and reported appropriately.

If you are an existing user and want some training, or you are new to Hedgebook and interested in learning more about the FX Exposure Tool simply get in touch.