One of our favourite roles at Hedgebook is working with our awesome development team to deliver new, cool functionality for our users. Recently we have been working on the development of an interactive tool to aid interest rate hedging reporting and decision making. The inspiringly named (?) Interest Rate Profile Tool replaces those clunky (and frequently erroneous) spreadsheets and provides information on future interest costs for budgeting purposes.

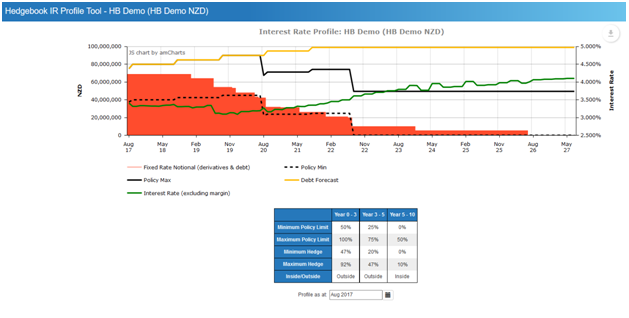

Example of the Interest Rate Profile Tool

The user can easily create alternative forecast debt scenarios (the yellow line in the chart) to stress test the impact on hedging levels and interest costs. This can be particularly helpful for those with increasing or decreasing debt profiles.

Hedgebook pulls through and displays the interest rate hedging policy (the solid (policy max) and dotted (policy min) black lines in the chart) for clear visualisation of the position. The table underneath the chart calculates the hedge profile versus limits and notifies the user whether the hedging position is policy compliant, or not. The profile can also be viewed at future dates e.g. key reporting dates, to avoid any future hedging versus policy limit reporting surprises.

All fixed rate hedging is included in the shaded orange area of the chart. This includes fixed rate bonds, interest rate swaps and interest rate options.

Annual forecast interest rates and dollar costs

The green line is the forecast interest rate which is a weighted average of fixed rate instruments plus the unhedged component at market implied floating rates. By adding a funding margin Hedgebook calculates annual forecast interest rates and dollar costs, as displayed in the table below:

The Interest Rate Profile Tool is accessed from the main page of the Hedgebook app (below the Valuation Date field). We encourage users to have a play, let us know your feedback and get in touch if you need some help.

If you are not yet a Hedgebook user, you can contact us here to arrange a short, on-line demo: https://www.hedgebookpro.com/contact/