The last three years have seen an awakening in global awareness of the need for interest rate risk management functionality – as a response to heightened inflation. Post COVID consumer led demand coupled with energy and food price shocks because of Russia’s invasion of Ukraine has prompted central banks to hike interest rates at breakneck speed.

History has shown the damage embedded inflation can do to an economy and how difficult it can be to tame it, hence central banks desire to get on top of it as quickly as possible. Although there are signs that interest rates may have peaked, it seems likely that we are in for an extended period of higher rates, not experienced before in the post GFC era (2008).

Awakening a need for new interest rate risk management functionality

So, it is of little surprise to us the significant surge in enquiries for Hedgebook from companies using interest rate derivatives to manage their debt position. The interest rate risk management environment has become far more interesting after a sleepy period of low rates that stayed lower for far longer than many would have expected (remember negative interest rates anyone?).

Many corporates use interest rate derivatives to manage their interest rate risk, particularly to protect against a higher interest rate environment and provide some interest cost certainty. Managing these derivatives is more easily achieved with systems that provide the appropriate controls and compliance.

Businesses need visibility over their debt, the usage of the funding lines in place, the facility maturity profile, the interest rate hedging position and so much more. Of course, independent valuations, IFRS reporting, monthly accrual calculations and the myriad of compliance requirements need to be covered off too.

Coincidentally, Hedgebook manages all the aforementioned aspects of interest rate risk and we have rolled out, additional, new functionality – including updates to the Interest Rate Profile Tool – in response to the feedback and requirements of existing and new users.

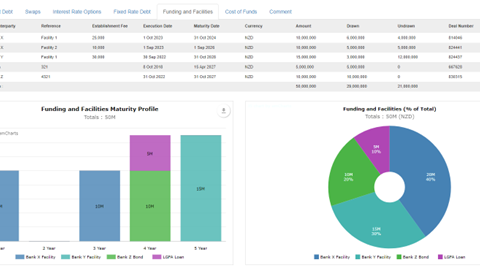

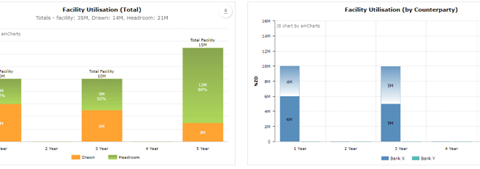

Debt funding: facilities, maturity and usage

You can capture your bank debt facilities plus any other sources of funding such as bonds placed through the debt capital markets. Hedgebook provides visuals of the debt funding maturity profile, the percentage split across counterparties and the facility usage of drawn versus undrawn funds. To see this in action – check out our quick overview video on Liquidity Management

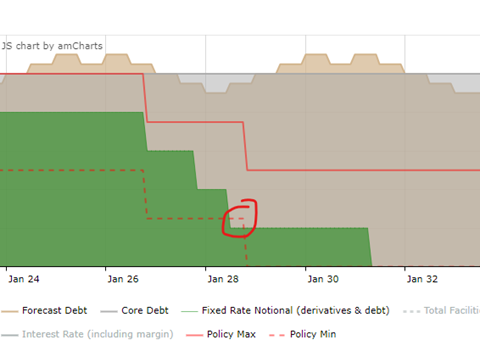

Core and forecast debt

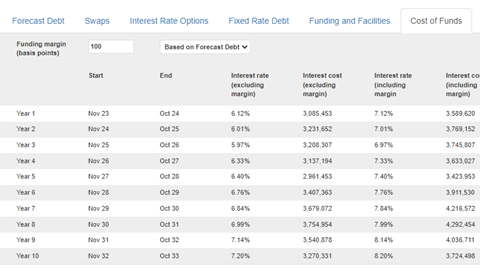

Users can provide core debt and forecast debt. In our experience companies will often use core debt to drive interest rate hedging decisions but also require forecast debt to understand interest cost outcomes.

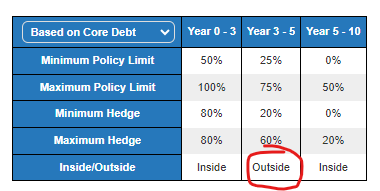

Policy compliance

By including policy minimum and maximum risk control limits users can identify areas that do not comply.

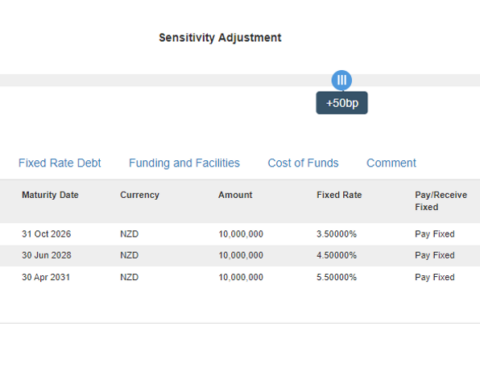

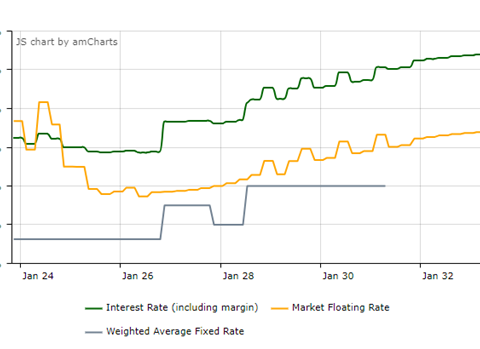

Trade ideas and scenario testing – Interest Rate Profile Tool

You can create a Trade Idea (hedging strategy) and flex the hypothetical interest rate scenario to understand the impact to your overall interest rates and costs. Too see this in action – check out our quick video overview of the Interest Rate Profile Tool.

Why not take a look for yourself?

If you are an existing user, you can find all the new interest rate risk management functionality within the Interest Rate Profile Tool (look for the button on the main page of the Hedgebook app).

If you have not yet taken the Hedgebook plunge, sign up for a quick online demo now.