PwC New Zealand, a leading treasury advisory provider in New Zealand, has collaborated with treasury software developer, Hedgebook, to create the foreign exchange hedging Strategy Tool. The FX Strategy Tool is an add-on module to the Hedgebook treasury management platform aimed at small-to-mid sized businesses that are exposed to foreign exchange markets.

A key part of PwC’s treasury advisory role is to provide strategic and tactical foreign exchange hedging advice within a company’s approved risk management framework. Implicit within PwC’s role is to monitor client’s financial market risk positions and provide specific and tailored hedging advice. In order to do this effectively, PwC relies on timely and accurate client risk position and exposure information. Some of PwC’s treasury advisory clients already use Hedgebook to record and report their FX hedging transactions and positions. Until now, Hedgebook had limited functionality to incorporate “what-if” hedging analysis when considering the impact of new or re-structuring of hedges.

FX strategy tool helps understand impact

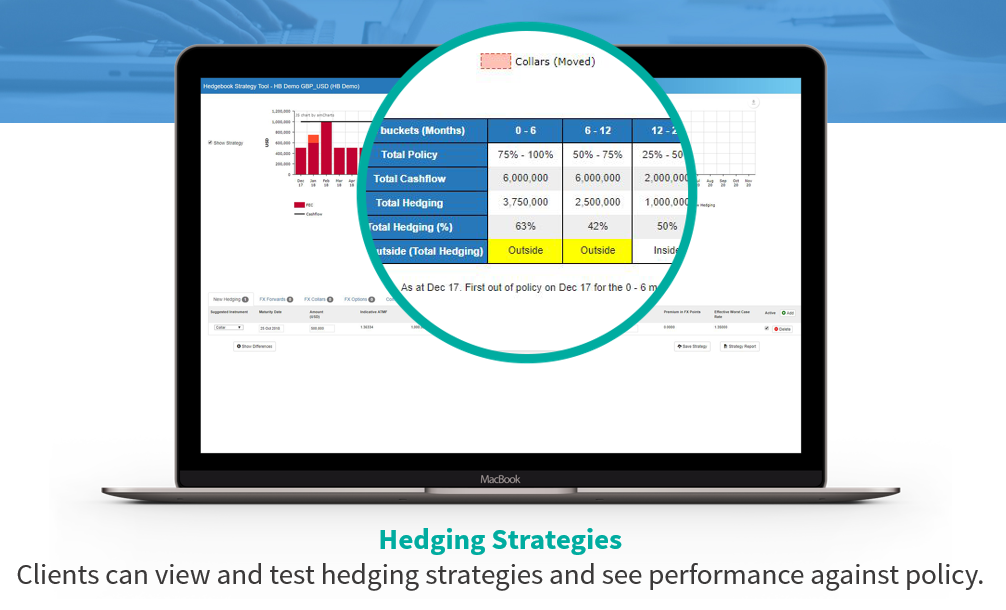

Hedgebook provides its users with an easy-to-use treasury management system to record, report and value foreign exchange derivatives such as forwards and options. The development of the Strategy Tool module gives users additional visibility over the impact of proposed or hypothetical hedging transactions on their hedging position (including at points in the future). For example, a common practice amongst companies managing FX hedging risk is to leave orders with their bank or FX broker at target FX exchange rates. By adding these orders into the Strategy Tool businesses will clearly understand the impact these orders will have on the hedging position if/when they are filled. The FX Strategy Tool can also scenario test the impact of a new forward FX contract, or changing the terms of an existing FX contract.

The FX Strategy Tool combines the existing hedges with projected foreign currency cash flows and enables users to add, remove, restructure, maturity extend or shorten any hedges in order for these to line up with the (often changing) timing and amounts of forecast FX cashflows. Users can now have access to the Tool – co-developed by leading treasury advisor, PwC and the treasury software developers – that means you project and understand the impact on your hedge position when making strategic decisions around foreign exchange hedging.

Hedgebook is excited to work with PwC Treasury Advisory, New Zealand to add further functionality to what is a widely used treasury management system in New Zealand and Australia (https://www.hedgebookpro.com/our-clients/). Hedgebook’s mission is to provide a low-cost solution to the small-to-mid size corporate market which relies heavily on error prone spreadsheets.

The FX Strategy Tool module is available to all Hedgebook users . Contact us here to arrange a demo: https://www.hedgebookpro.com/contact/.