We first wrote this blog in 2015, largely to help those starting out in the industry to better understand some of the terms being used. Funnily enough – the need is just as great today, if not greater. We still find many in the industry – including those in quite senior roles struggle to understand how an interest rate swap works.

Why use an interest rate swap?

Interest rate swaps (or IRS) are often simply described as an exchange of cash flows. Either fixed for floating or floating for fixed, to hedge interest rate risk.

However, the best way to understand an IRS is by way of an example. The easiest example is that of a borrower who wishes to fix their interest rate exposure. Many of us borrow money from the bank in the form of a mortgage for our home and we choose to lock in the certainty of the interest rate payments by fixing the interest rate for a few years. A pretty simple concept.

The corporate borrower has a few more options available to them to achieve certainty over interest costs on borrowings. They can borrow on a fixed rate basis similar to our residential mortgages. Alternatively, they could borrow from the bank on a floating rate basis and then enter a pay fixed interest rate swap to lock in the interest rate. The outcome is the same.

However, the advantage of the IRS is the flexibility it allows the borrower in regards to the term you can fix and the flexibility to restructure. It is common for a borrower to fix through the IRS market out to ten years or longer. It is much harder, and more expensive, to get the bank to fix interest rates long term. Banks need to be compensated for tying up capital for such an extended period of time.

It is also much harder, and expensive, to break debt that has been borrowed on a fixed rate basis. Comparatively, restructuring an IRS is a straightforward process. It also allows the corporate borrower to take advantage of prevailing interest rate market opportunities or “play the yield curve” to use financial market parlance.

How does an interest rate swap work?

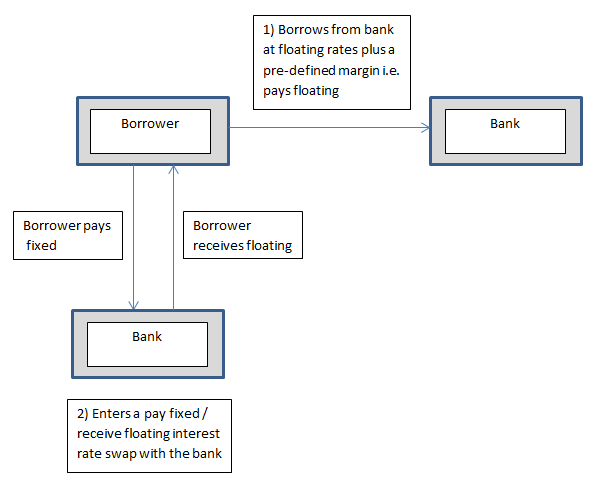

Explaining how an IRS works require us to understand the concept of exchanging cashflows. The diagram below represents the cash flows associated with a borrower using an IRS to fix interest costs:

- The company borrows money from the bank, say $10 million for our example, on a floating rate basis. There are floating-rate benchmarks for different currencies i.e. BKBM in NZ, BBSW in Australia, EURIBOR in Europe etc., which changes/sets every day. The bank will charge a margin on the money it lends e.g. 2% The effect for the company is it borrows money at a floating rate + 2%

- The company wishes to fix the interest cost. To achieve this it enters a pay fixed/receive floating IRS with a bank (maybe the same bank as it has borrowed from, but not necessarily). Assuming the company wishes to fix the entire $10 million i.e. the swap is entered for $10 million.

It could just as easily decide to fix only half the amount i.e. $5 million. This is where you see some of the flexibility an IRS allows the company when considering its interest rate risk management profile. Under the terms of the pay fixed swap, the borrower will pay the bank a fixed interest rate and receive floating interest from the bank i.e. exchange of cashflows. Note, there is no exchange of principal, only interest.

The floating rate received through the swap offsets the floating rate paid to the bank for the debt. The net impact to the borrower is paying a fixed rate (through the swap) plus the margin the bank charges for borrowing the money (2%).

Factors to consider

Firstly, the roll-dates of the IRS should match that of the debt. That means, if the floating rate on the debt sets every three months then so should the floating rate on the IRS, and on the same day.

The underlying reference rate on the debt and the swap should also match i.e. BKBM, BBSW, EURIBOR, etc. Both things ensure there is no “basis risk” within the hedge. It also ensures it passes muster from a hedge accounting perspective if it is designated into a hedge relationship.

The example above is designed to provide a basic understanding of the concept of an IRS. We have used the floating rate borrower as an example. However, interest rate swaps are used by an array of market participants for a multitude of uses. This includes investors wishing to structure their income profiles or borrowers who have borrowed on a fixed term but wish to have exposure to floating interest rates.

Hopefully, this has improved your understanding of Interest Rate Swaps. Of course, managing IRS and other financial instruments is infinitely easier using a tool like Hedgebook. Take a couple of minutes to check out our overview video to see exactly how it might help you.