FX options make up an element of many companies’ currency risk management strategies. FX options lock in the certainty of worst-case exchange rate outcomes while allowing participation in favourable rate movements.

In our experience, companies are often reluctant to pay a premium so for many the preferred strategy is collar options. A collar option involves writing or selling, an FX option simultaneously as buying the FX option in order to reduce the premium, often to zero.

After transacting the FX option, the challenge comes for those that are hedge accounting and the requirement to split the valuation of the FX option into time value and intrinsic value. IFRS 9 allows the intrinsic value of FX options to be designated in a hedge relationship and can, therefore, remain on the balance sheet. The time value of the FX option is normally recognised through profit or loss.

The intrinsic value of FX options is the difference between the prevailing market forward rate for the expiry of the FX option versus the strike price. We can use a UK based importer paying for goods in USD as an example.

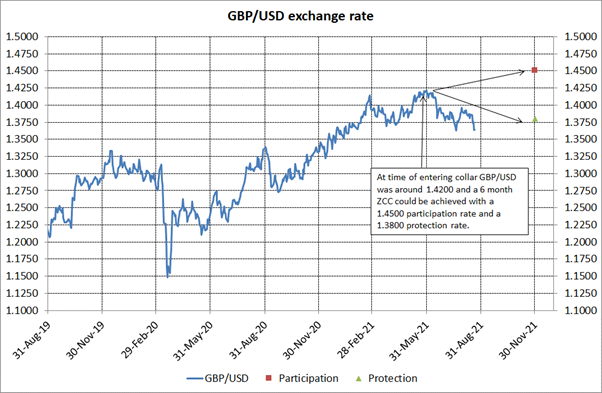

In our example, the importer forward hedged US$1 million of payments three months ago purchasing an option that expires in six months (the USD is due to be paid in three months’ time). At the time of hedging, the GBP/USD rate was 1.4200 and the six-month forward rate was 1.4195.

Zero Cost Collar

The company chose to hedge with a six-month zero-cost collar (ZCC) i.e. the premium received from the sold option offsets the premium paid on the bought option. Three months ago a ZCC could have been entered as follows:

- Option 1: Bought GBP Put / USD Call at a strike of 1.3800

- Option 2: Sold GBP Call / USD Put at a strike of 1.4500

The intrinsic value of each leg of the collar will be determined by the difference in the forward rate at the valuation date versus the strike rates. For option 1, the bought option, if the forward rate is lower than the strike of 1.3800 then the FX option will have positive intrinsic value i.e. it is “in-the-money”.

FX options intrinsic value

It is important to note that the intrinsic value of a bought FX option cannot be negative. The purchaser, or holder, of the FX option, has all of the rights and would not choose to exercise the FX option if the market rate was above the strike price. They would simply choose to walk away from the FX option, let it expire worthlessly, and transact at the higher market rate.

For the sold FX option the opposite is true. If the forward rate is above the strike price (higher than 1.4500 in our example) then the importer, as the writer of the option, will be exercised upon and the difference between the market rate and the strike rate will be negative intrinsic value. The intrinsic value of a sold FX option cannot be positive.

The time value of an FX option is the difference between the overall FX option valuation and the intrinsic value. By its definition, the time value is a function of the time left to the expiry of the FX option.

Time to expiry

The longer the time to expiry, the higher the time value as there is a greater probability of the FX option being exercised. A purchased FX option begins life with a positive time value that decays over time to zero. A sold FX option begins life with a negative time value and tends to zero by the expiry date.

When hedge accounting for FX options the splitting of intrinsic value (balance sheet) and time value (P&L) does not have to be a time-consuming exercise. At Hedgebook we like to make life easy so as part of the FX Options Held Report the valuations are automatically split by intrinsic value and time value.

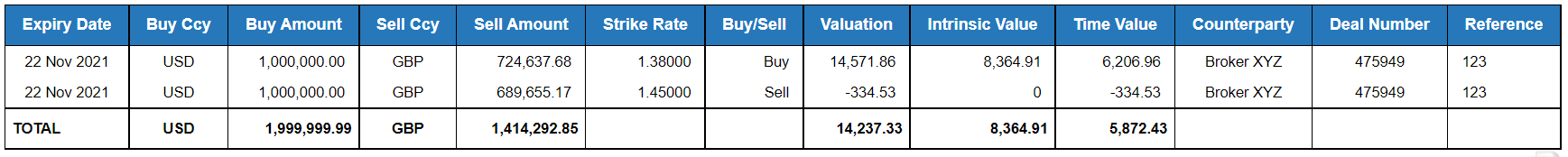

The screenshot below shows the Hedgebook output using our UK exporter example:

Sold option

With the weakening of the GBP/USD exchange rate in the last three months we see the intrinsic value of zero for the sold option at a strike of 1.4500 and very little time value as there is little chance of the GBP strengthening to above 1.4500 by the time the option expires in three months time.

Bought option

The bought FX option has a large, positive mark-to-market value made up of time and intrinsic value. If, at expiry, the prevailing market rate is at the rate implied by today’s forward rate the importer will exercise the option and be able to sell GBP / buy US$1 million at GBP/USD 1.3800 versus a market rate of closer to 1.3640 (intrinsic value).

Easing the pain – time versus intrinsic value management

Hedgebook’s easy to use currency risk management software calculates FX option valuations split into intrinsic and time value. This simplifies life for those that already use FX options and hedge account, whilst removing obstacles to hedge accounting for those that perceive the accounting requirements as too hard. Hedgebook eases the pain of hedge accounting FX options.