Every year thousands of readers like you benefit from this common-sense approach to the calculation of foreign exchange (FX) forward points – the time value adjustment made to the spot rate to reflect a future date. First published 10 years ago, we regularly review and update the FX forward points content – this is the latest edition:

The forward foreign exchange market is very deep and liquid and is used by an array of participants for trading and hedging purposes. In the corporate world many importers and exporters hedge future foreign currency commitments, or forecasts, using forward exchange contracts (FECs).

The table below shows a selection of the forward points and outright rates for a number of currency pairs:

Table 1: Forward points and outright rates

For example, the GBP/EUR 1-year forward points are currently -131, while the GBP/EUR spot rate is 1.1423. Therefore, at today’s rates a forward rate of 1.1423 – 0.0131 = 1.1292 can be secured for a contract with a value date in one year’s time. But how did the GBP/EUR 1-year forward points come to be -131?

Common misunderstanding

The common misunderstanding is that they are traded like the spot rate i.e. based on currency traders’ views for the outlook of a currency’s fundamentals. This is incorrect. FX points are mathematically derived by the prevailing interest rate markets. Using our example of the GBP/EUR 1-year forward points, -131 is a result of the 1-year GBP and EUR interest rate outlook.

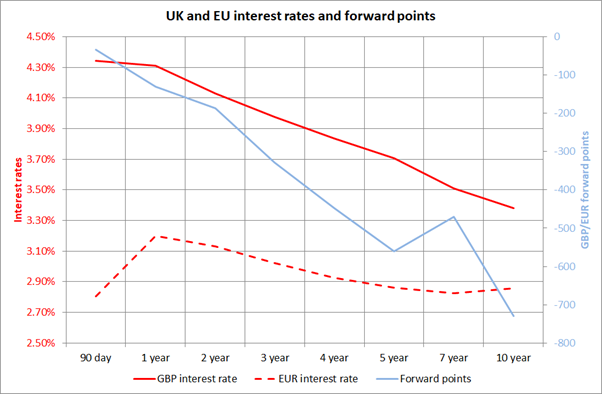

There has been a rapid change of global interest rates from the historically low environment we were in the last time this blog was updated, but as before it is the interest rate differential between the two currencies that feeds into the calculation of the forward points. The chart below shows the UK interest rate yield curve versus the EUR and the corresponding FX forward points. Note the RHS axis shows greater negative forward points over the 10-year horizon of the chart.

Chart 1: GBP and EUR interest rates and GBP/EUR forward points

The interest rate market is telling us that the GBP 1-year swap rate is 4.31% while in EUR it is 3.20%. So how does this equate to -131 FX points?

FX Forward Points Example

EUR1,000,000 at a spot rate of 1.1423 = GBP875,427

If EUR1,000,000 is invested for one year at a EUR interest rate of 3.20% per annum, at the end of one year EUR1,000,000 is EUR1,032,000.

If GBP875,427 is invested for one year at a GBP interest rate of 4.31% per annum, at the end of one year GBP875,427 is GBP913,158.

The equivalent exchange rate is EUR1,032,000 divided by GBP913,158 = 1.1301

1.1301 – 1.1423 = -0.0122 (or -122 FX points in the parlance of the FX markets).

The bid/ask spread of the FX and interest rate markets accounts for the 9 FX point balance. The example serves to provide a “back of the envelope” guide to calculating FX forward points and outright rates.

Insight on interest rates

Even though the calculation of the forward points is mathematically derived from the interest rate market, interest rates themselves are the market’s expectation of the outlook for an economy’s fundamentals i.e. subjective. Therefore, the FX forward points are derived from traders positioning on interest rate differentials.

Exporters from countries with traditionally higher interest rate environments, such as New Zealand and Australia, benefit from the negative forward points, while it is a cost to importers. An exporter wants a weak base currency so large negative forward points are an economic advantage. With an upward sloping interest rate yield curve (or more correctly positive interest rate differential) forward points will be more negative the longer the time horizon.

An importer wants a strong currency, therefore, negative forward points are detrimental to the hedged conversion rate. The impact of negative forward points is a reason that exporters often have longer term hedging horizons compared to importers because the impact of forward points are not penal.

Forward exchange contracts are a flexible, and relatively easy to understand, hedging tool that is commonly used to bring certainty to those grappling with foreign exchange exposures and the volatility of the financial markets.

Hedgebook has a mission to help businesses of all sizes make sense of treasury and FX risk, devise profit-protecting strategies and collaborate more effectively with banks and brokers via our market-leading SaaS platform.

If you found this blog useful – it is likely you will benefit from taking a look at our FX Exposure Tool as well.