A key pillar of Hedgebook’s ethos is to make life easier for corporates in managing and reporting their financial derivative exposures. This approach extends to aiding Treasurers and CFOs comply with the ever increasing compliance requirements of accounting standards. The most recent standard to create further onus on corporates is the CVA requirements of IFRS 13. We have discussed IFRS 13 on numerous occasions via this blog (and will continue to do so!)

However, the focus of this blog post is the disclosures required by IFRS 7 and specifically the quantitative disclosures in assessing the risks faced by an entity in regards to its financial instruments. Quantifying the risks is demonstrated via a sensitivity analysis.

The Hedgebook application allows a user to perform sensitivity analyses on foreign exchange and interest rate positions at the press of a button and in doing so helps achieve compliance to IFRS 7 as simply and efficiently as possible. These numbers can be included directly into the Notes to the Financial Statements.

Interest Rate Swaps

There is a report within the suite of Hedgebook interest rate reports called the IR Sensitivity Report. A user is able to run the sensitivity analysis in three easy steps:

– select the appropriate interest rate swap portfolio or individual deals

– select the valuation date and currency

– run the IR Sensitivity Report

The Hedgebook app produces the fair value per instrument based on the valuation date zero curve and also the fair values following pre-defined shifts in the yield curve.

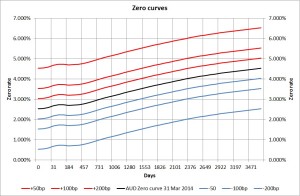

Using the 31 March 2014 AUD zero curve as an example, the chart below shows the actual zero curve plus the alternative yield curves that are applied to the swap portfolio:

The zero curve is flexed by a parallel shift of +/-25,+/-50, +/-100 and +/-200 basis points. The output of the report is the hypothetical fair value of each transaction under the aforementioned yield curves. The analysis provides information about the extent to which the entity is exposed to risk. The subsequent Hedgebook report can be printed, copied into a document or downloaded to excel for inclusion in the Notes to the Financial Statements.

Foreign exchange

Hedgebook’s sensitivity analysis for fx instruments follows a similar vein to interest rates. The fx curve (spot plus forwards) is flexed by a +/-1%, +/-5%, +/-10% and +/-20% to derive the hypothetical valuations. The subsequent Hedgebook report can be printed, copied into a document or downloaded to excel for inclusion in the Notes to the Financial Statements.

Summary

As regulatory and compliance requirements continue to increase it is important that corporates find ways to increase efficiency and find alternative ways to complete increasing workloads without increasing personnel. A low cost system such as Hedgebook allows senior members of the finance team to focus on added value tasks and not become encumbered by compliance requirements that can be automated such as sensitivity analyses for IFRS 7 disclosure requirements.